IT services firm Tech Mahindra is expected to report a marginal decline in net profit for the first quarter of this fiscal amid flat-to-negative revenue growth due to lower tech spends triggered by the economic slowdown in the West, analysts said.

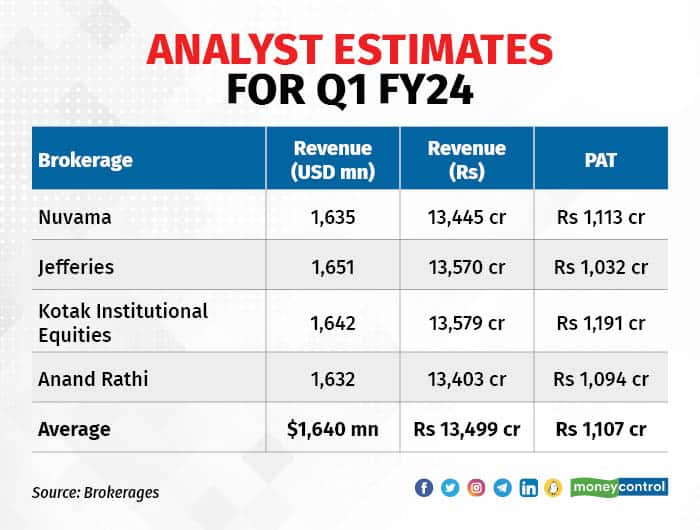

The Mahindra Group firm is likely to report a net profit of Rs 1,107 crore, representing a decline of 2.12 percent YoY, as per the average of a poll of estimates of four brokerages.

Tech Mahindra had posted a consolidated net profit of Rs 1,131 crore in the first quarter of the preceding fiscal FY23.

When compared sequentially, the company’s net profit is seen contracting by 0.90 percent compared to Rs 1,117 crore in Q4 FY23.

Revenue is estimated to grow 6.23 percent to Rs 13,499 crore from Rs 12,707 crore in Q1 FY23. However sequentially, it is expected to decline from the consolidated revenue of Rs 13,718 crore clocked in the preceding quarter Q4 FY23.

“We expect TechM to report -2.3 percent QoQ decline in constant currency and -2 percent in USD -- driven by overall weak macro, lower tech spend and Q1 seasonality,” analysts at Nuvama Institutional Equities said in a note to clients.

It also expects margins to decline by 110 bps QoQ -- mainly due to wage hike, Q1 seasonality and decline in revenue.

The company’s EBITDA margin stood at 11.2 percent in the preceding quarter and 11 percent in Q1 FY23.

“Deal wins are expected to be modest, and so is the overall outlook,” it added.

Choppy Waters

Foreign brokerage Jefferies expects Tech Mahindra's 1Q revenues to decline by 1.5 percent QoQ (in constant currency terms), impacted by weakness in the communication vertical, seasonal weakness at its subsidiary Comviva and overall macro weakness.

“EBIT margin to decline by 150 bps QoQ due to revenue decline and wage hikes. Deal wins likely to be soft similar to last quarter,” it added.

Tech Mahindra had posted a 26 percent decline in consolidated net profit for the March quarter of 2022-23, while revenue from operations stayed flat on a sequential basis and up 13 percent on-year.

In a note, Kotak Institutional Equities said Tech Mahindra is likely to post a sharp 3 percent QoQ decline in revenues in the communications vertical and flattish revenues in enterprise segment.

“Revenue decline in communications vertical is due to seasonal weakness in Comviva and ramp down by a large telecom client. Of particular focus will be weak top five client billing,” it noted.

Revenue decline will likely feed into margins.

“We build in EBIT margin decline of 40 bps on a sequential basis due to decline in Comviva margin. Lack of leverage from growth is the key headwind. Utilization levels are maxed out and will provide limited tailwinds,” the domestic brokerage added.

Dismal growth, guidance downgrades, declining headcount: How Indian IT majors fared in Q1

Analysts said the overall weak global macro and slow decision-making will likely feed into muted deal wins.

In such a scenario, the focus will shift entirely to turnaround initiatives and margin expansion strategies of CEO- Designate, Mohit Joshi, Kotak said.

The brokerage added that other key factors to watch will be the near-term growth outlook given by the firm, timing of divestments of low-margin businesses, health of deal pipeline and outlook for revenue growth in top telecom clients.

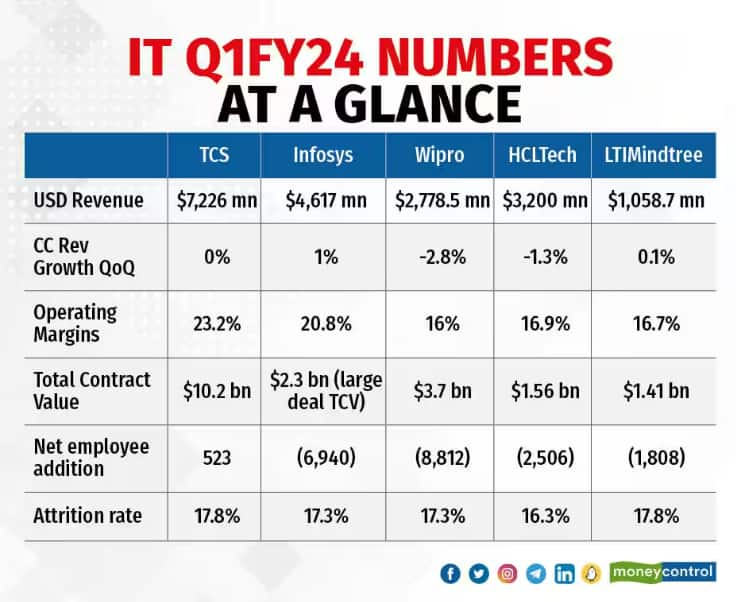

Most IT firms have posted lacklustre numbers for the June quarter, impacted by the recessionary headwinds in Europe and US – the bread-and-butter markets for the domestic IT players.

“We expect macro-related uncertainty, likely slowdown in tech spends and supply-side pressure to impede growth in the near-term at least in 2 more quarters,” brokerage Ashika said in a recent report.

The top five Indian IT companies (by market capitalisation) have seen their sequential revenue growth on a constant currency basis at anywhere between -2.8 percent and 1 percent, a far cry from the high single-digit and double-digit growth seen last year. The biggest shocker, however, was Infosys’ sharp guidance cut for the year from 4-7 percent to 1-3.5 percent.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!