Highlights

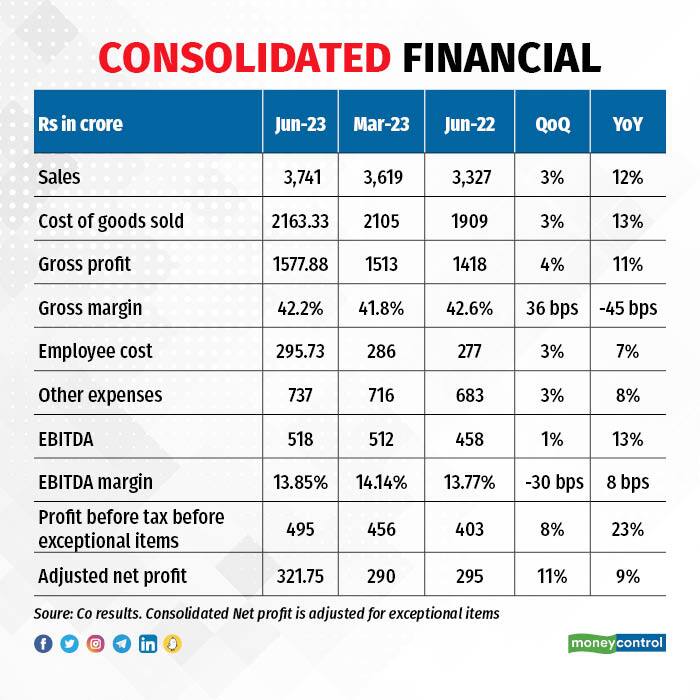

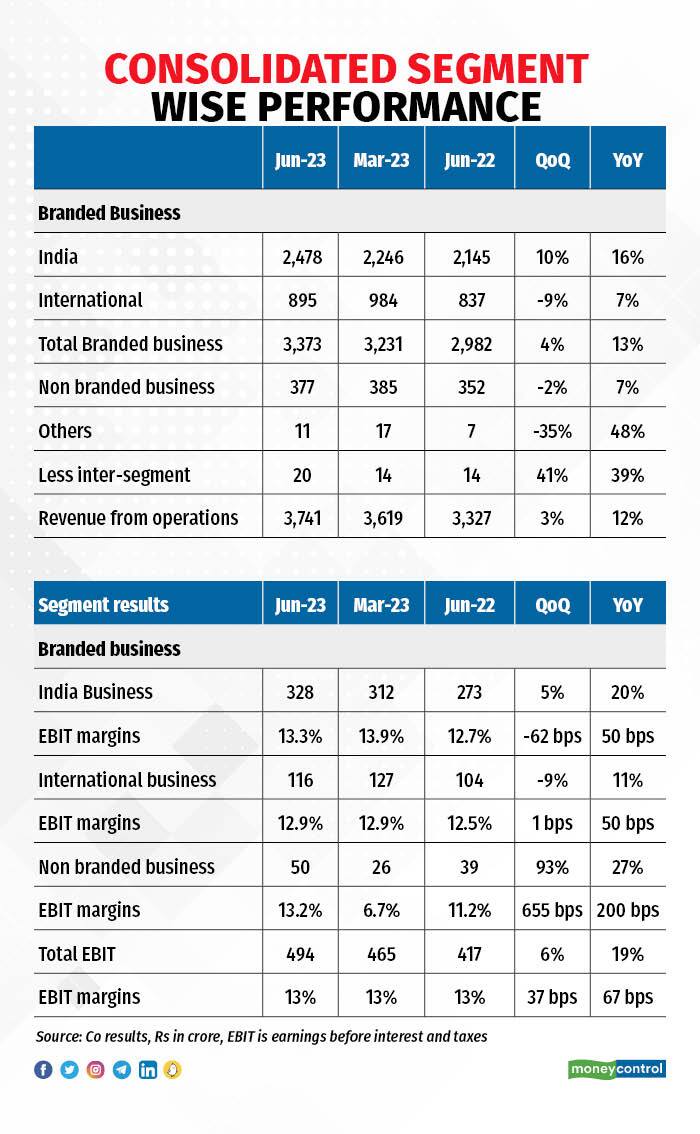

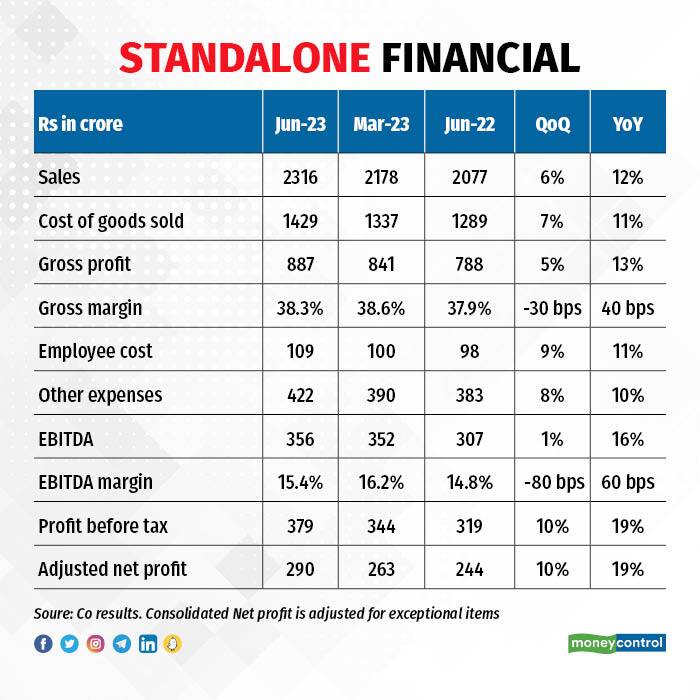

Tata Consumer Products’s (CMP: Rs 850; Market capitalisation: Rs 78,953 crore) Q1FY24 results were broadly in line with expectations. Consolidated revenues grew by 11 percent in constant currency terms year on year (YoY), on the back of a 16 percent growth in India business, 3 percent growth in constant currency terms in international markets, and 5 percent constant currency growth in non-branded business.

India packaged beverages business saw 2 percent revenue growth and 3 percent volume growth. Tata Tea Premium and Tata Tea Agni recorded strong volume growth in the June 2023 quarter. Volume market share in tea was down by 30 basis points while value share was down by 110 basis points on a moving annual total (MAT) basis. Coffee saw revenue growth of 21 percent YoY.

India foods business saw a 24 percent revenue growth and 6 percent volume growth. The salt portfolio continued its revenue growth during the June 2023 quarter, on a high base of last year. The market share in salt was down by 30 basis points on value basis.

The Tata Sampann portfolio grew 51 percent YoY on the back of a soft base. Tata Soulfull saw a strong quarter and entered new categories with new launches to expand the total addressable market. Dry fruits had another strong quarter, growing by 100 percent.

Nourishco (100 percent subsidiary) saw a revenue growth of 60 percent despite adverse weather conditions and touched a revenue figure of Rs 293 crore. Tata Gluco Plus and Tata Copper, both grew by 61 percent and 71 percent, respectively. Profitability improved significantly, led by lower cost and operating leverage. TCPL’s target is to reach Rs 1,000 crore for Nourishco in FY24.

Tata Coffee (including Vietnam operation and excluding Eight O’Clock Coffee) saw a revenue growth of 11 percent, led by the plantation business. Vietnam operation performed well with strong sales and improved profitability, supported by sales of premium products.

Tata Starbucks recorded a revenue growth of 21 percent YoY. It opened 16 stores during the quarter and entered four cities, bringing the total number of stores to 348 across 46 cities. Business remained EBIT-positive, despite strong store additions.

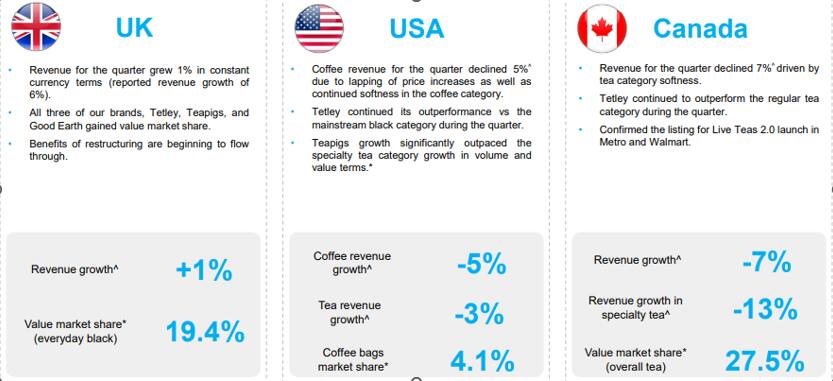

International operations: International business saw 7 percent revenue growth. US coffee business saw a volume decline by 12 percent while international tea saw an 11 percent volume decline.

Source: Co presentation

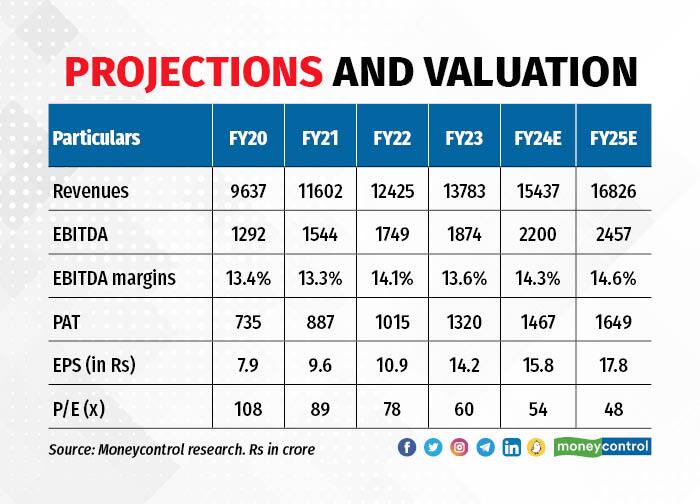

Outlook and valuations

TCPL continues to witness improving demand trends in core categories and remains cautiously optimistic, subject to rural recovery and a normal monsoon. It has already taken interventions for its tea business in India, and this has started to yield positive results, leading to volume growth. However, volume growth still remains below its medium-term aspiration.

In the salt business, growth is likely to come from volumes and premiumisation for the remainder of FY24 as against the pricing growth witnessed in the last three quarters.

New categories like Sampann, Soulfull and Nourishco now contribute 20 percent to India sales in the June 2023 quarter, compared to 15 percent in the June 2023 quarter and their combined revenues grew by 58 percent.

In the international business, pricing actions and structural interventions have led to a sequential improvement in margins for three quarters now. However, demand softness continues. The management remains hopeful of some recovery, going forward, as the benefits of price hikes will flow through in the next two quarters. It will lead to a further improvement in margins, and is expected to reach a historical average of 12-13 percent.

TCPL is on track to reach 4 million domestic outlets by September 2023 as compared to 3.8 million outlets in March 2023, effectively doubling their total reach since September 2020. TCPL continues to increase bandwidth at the front end through the split route for salesmen in towns with a population of 1 million plus and the results have been encouraging so far.

TCPL is behind the curve in terms of advertisement spends as against its peers, which is likely to grow, going ahead, given that commodity inflation is now behind them. In the current quarter, advertisement spend was around 7 percent to revenues in the India branded business.

TCPL’s focus on foods business and recovery in its core categories of tea and salt will lead to a higher growth rate. We remain positive on TCPL and advise investors to buy and accumulate the stock on declines for the longer term.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Cipla, Dr Reddy’s deliver a pep pill for pharma stocks

Jul 27, 2023 / 03:58 PM IST

In today’s edition of Moneycontrol Pro Panorama: New Delhi needs strategic approach towards China, Colgate brings cheers to inve...

Read Now

Moneycontrol Pro Weekender: Climbing Mount 20k

Jul 22, 2023 / 10:00 AM IST

Emerging markets are in the spotlight as the shift in foreign capital flows has been driven by disappointment about China’s reco...

Read Now