Now that we are just past the halfway mark for 2023, it is time to take stock of what has happened in asset markets around the world: in equities, fixed incomes, currencies and commodities.

But first, the back story. 2022 was about the worst year in asset markets... even on a one-century basis!

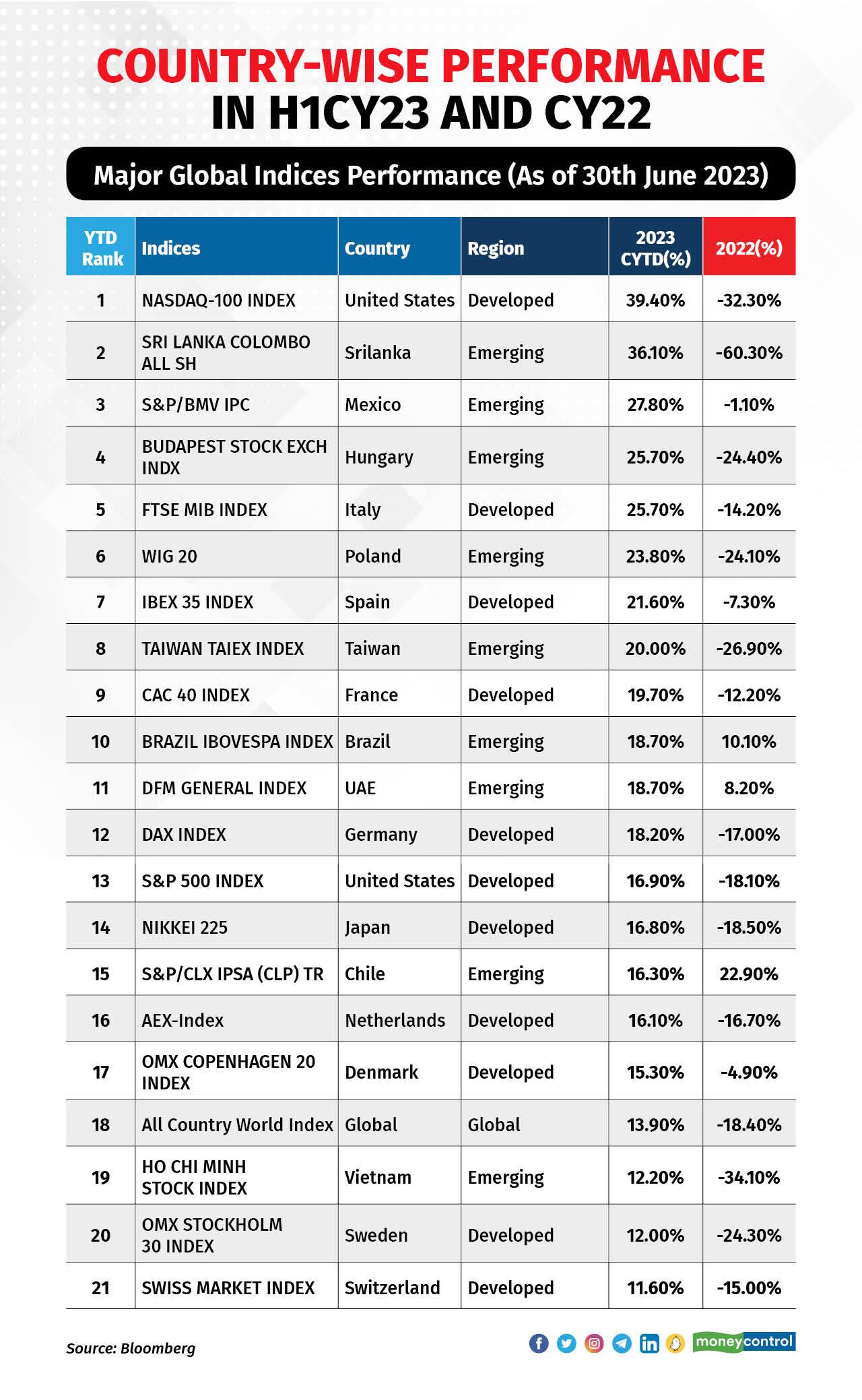

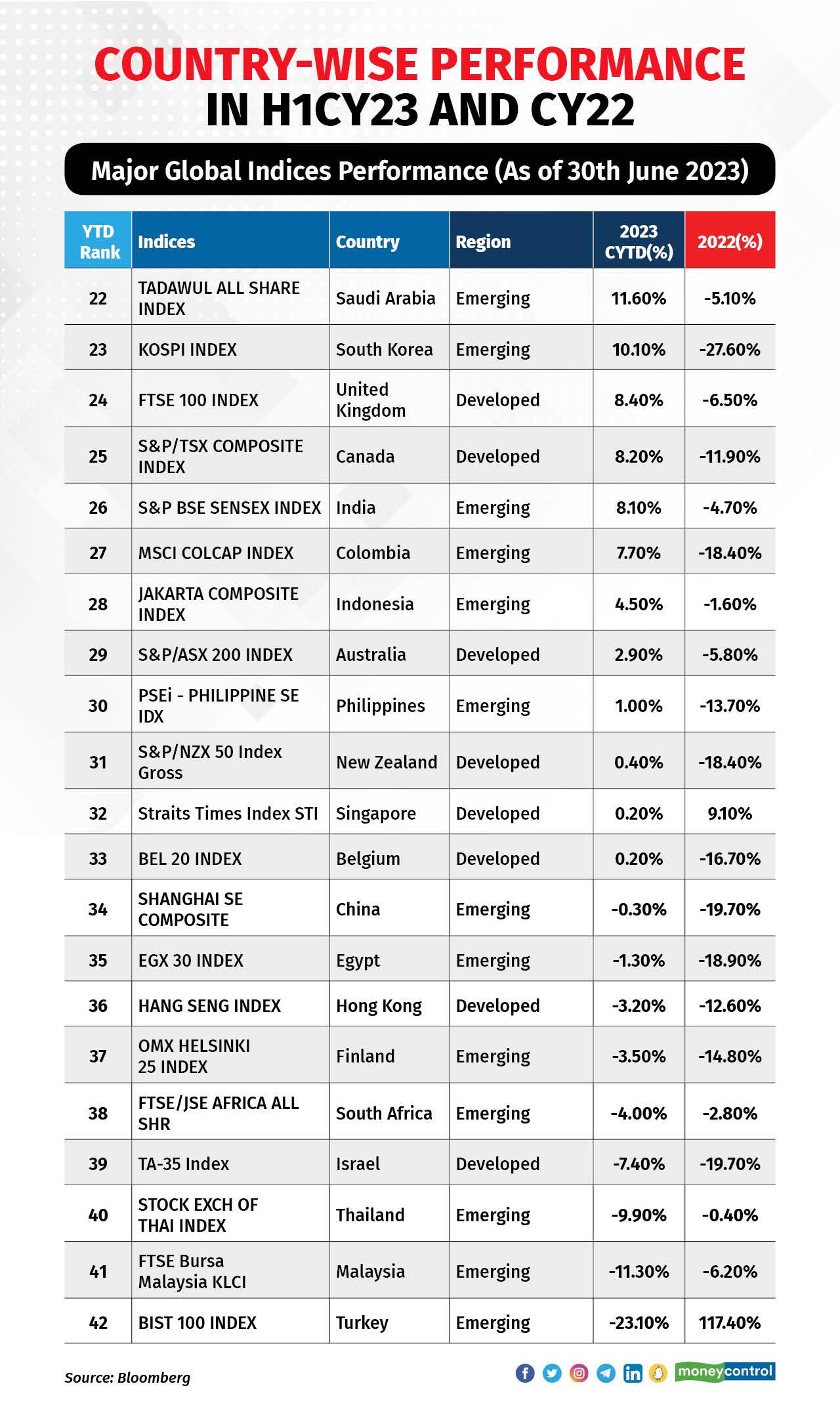

During CY22, major indices like NASDAQ, Global markets Ex-US (ACWX), and EM markets (EEM) experienced significant declines of 17-28 percent.

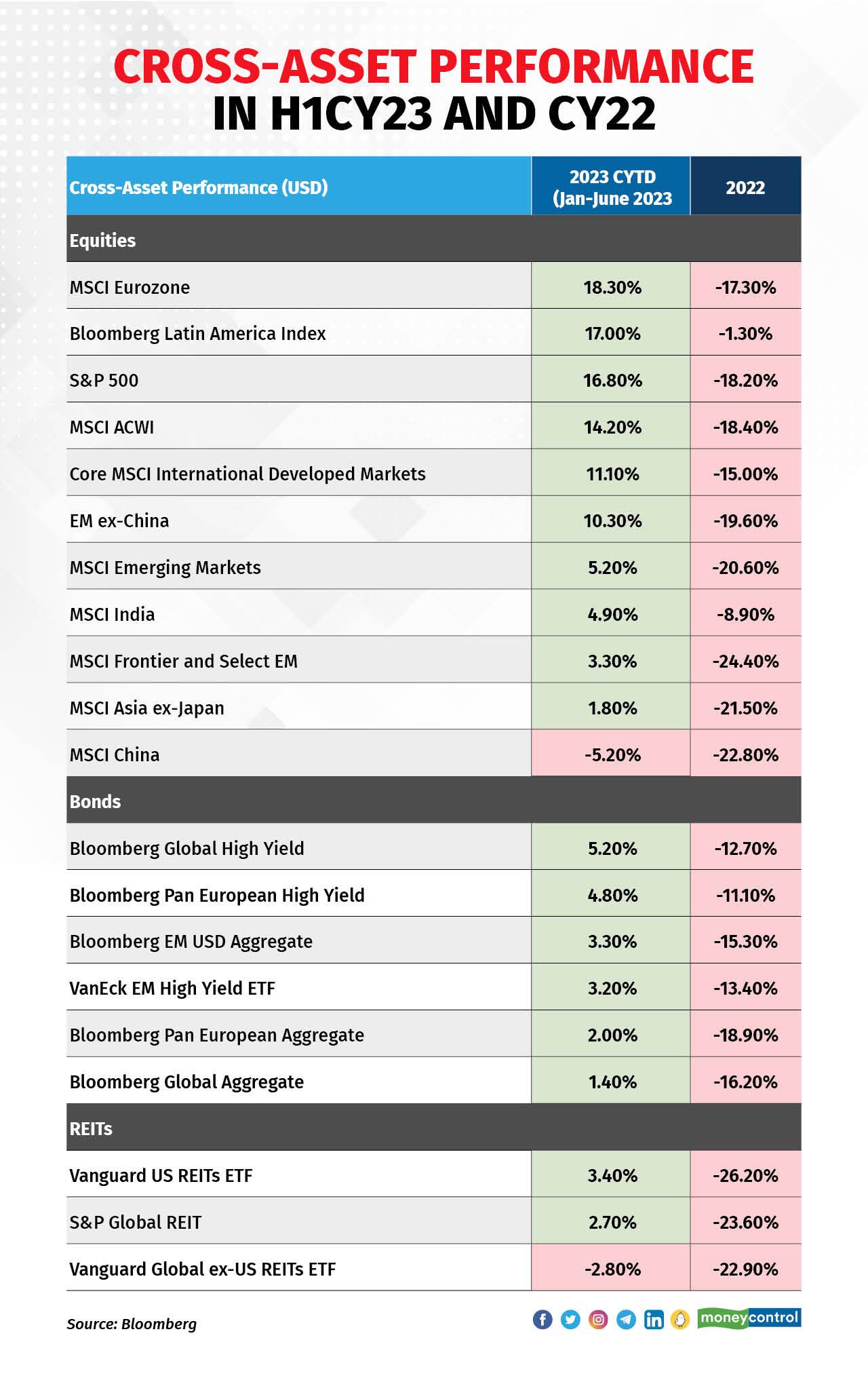

Even other asset classes, including fixed income and REITs, also saw notable losses.

How much of an outlier year 2022 was is borne out by the fact that it was the worst year for bond markets in 230 years of recorded history.

And, one of the worst years for stocks and bonds falling together, which itself had happened last in 1969!

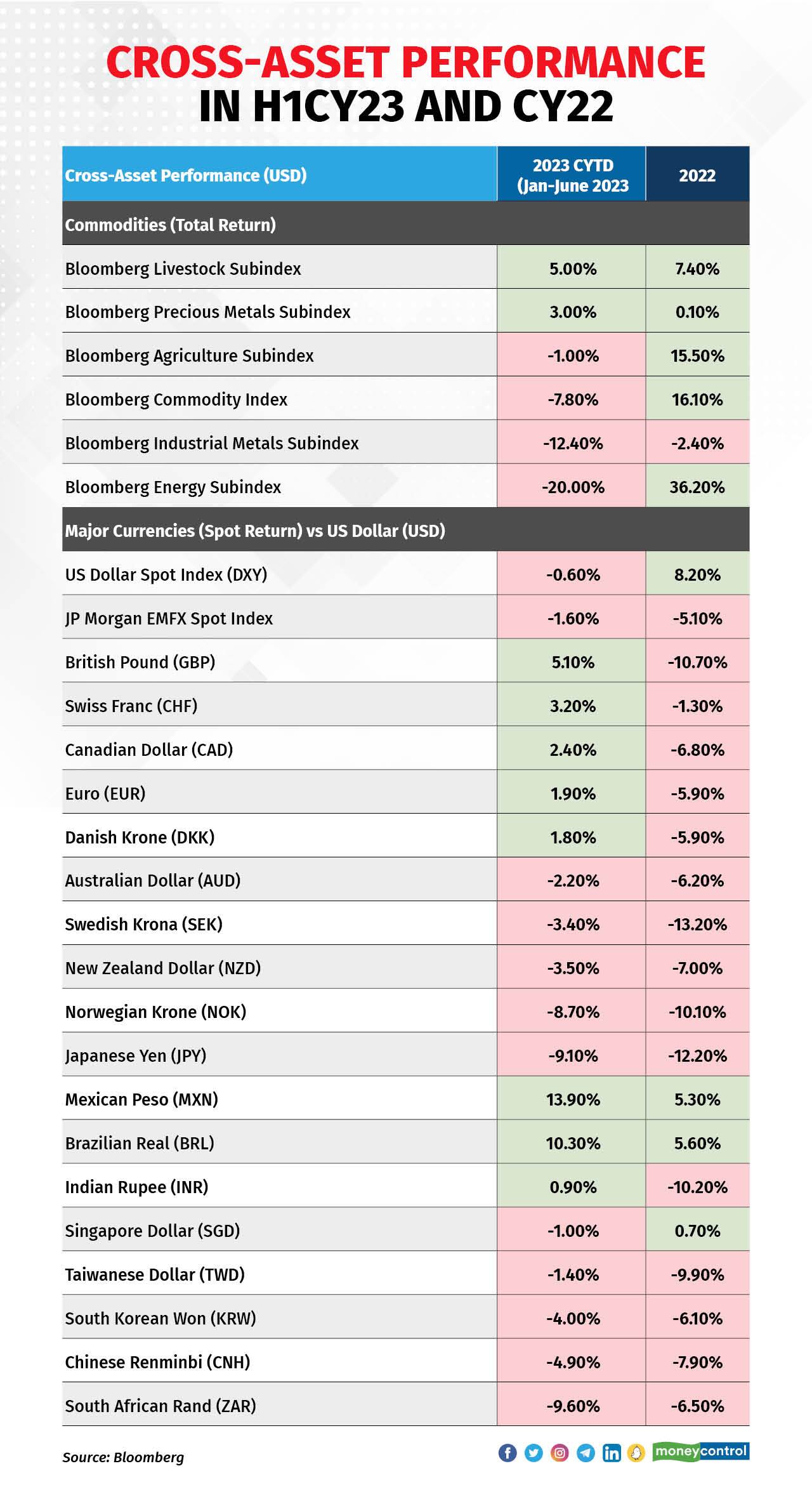

The only assets up for the year were a couple of subsets of commodities: Energy (oil and gas) and a few agricultural commodities… that is it. Every single regional equity index was down, as was virtually every bond index.

After this disastrous year, I was clear that it was extremely unlikely that 2023 would be a down year as such years do not repeat back to back.

Lo and behold, the first half of 2023 witnessed a reversal in the fortunes of previously beaten-down assets, surprising many market participants who were simply extrapolating the recent past.

This bounce-back has been in spite of the fact that many reasons or excuses could have been found if the markets had gone down. The narrative could have been built to explain either a rally or a rout.

To summarise the major events of H1 2023:

Macroeconomic data turned out better than feared, and inflation continued to decline, albeit at a slower pace than anticipated by some.

In H1CY23, the global equity benchmark, the All Country World Index, which experienced an 18 percent drop in the previous year, surged by 15 percent. The US, Latin America, and the Eurozone saw significant gains of 17-18 percent.

However, Asia ex-Japan lagged behind, mainly due to China.

Japan's Nikkei 225, the poster child for how long equity markets need NOT give returns, reached a 33-year high.

While many global markets are yet to reach their former peaks, India, Japan, France, Italy, and Spain have achieved new highs.

And, of course, the star was last year's super laggard NASDAQ, which has made a remarkable recovery by erasing nearly all its losses from 2022 with a 39 percent increase.

Overall, the world equity benchmark has yet to fully recover from last year's bear market, with stocks, on the average, still more than 10 percent below their peak.

Market breadth, a concern

Equity returns this year have been quite narrow, driven by a small group of tech stocks, and particularly the semiconductor stocks.

The heavy reliance on these stocks may pose a risk to the world's best-performing equity markets if sentiment on AI weakens.

For instance, over half of Korea's H1 gain is attributed to Samsung, and more than half of Taiwan's return comes from Taiwan Semiconductors. In the Netherlands, 64 percent of the advance is from ASML.

In the US, more than 70 percent of the return was driven by seven mega-cap tech stocks in the index: Apple, Alphabet, Microsoft, Meta Platforms, Amazon.com, NVIDIA and Tesla.

Tech-heavy markets like Taiwan and Korea are up 10-20 percent in dollar terms, but still have a way to go in fully recovering from the losses of 27-28 percent witnessed in 2022.

Beaten down sectors and markets of 2022 catch up in H1 2023

In the All Country World Index, which tracks equities from developed and emerging markets, every sector except Energy (-1.8 percent) and Gas Utilities (-0.5 percent) showed positive performance.

Nevertheless, more than 50 percent of this move was led by the technology sector, up 40 percent. The other sectors that give good returns were Consumer Discretionary (+25 percent), Communication Services (+26 percent), and Industrials (+13 percent). Notably, these are the same sectors that dropped more than 30 percent last year (except industrials, which fell 12 percent).

Even in terms of major indexes the Nasdaq and Sri Lanka which were near the bottom of the list last year, are topping the performance chart.

The macro outlook

After being a primary concern for central bankers worldwide, inflation finally showed signs of slowing in 2023. Although headline inflation decreased by 2 to 5 percent points from its peak in developed regions like the US, UK, and Europe, core inflation, which excludes volatile items such as food and energy prices, remained stubbornly high.

This indicates that progress in combating inflation has been insufficient, leading to a market perception that rate cuts are unlikely this year, which had been my view all along.

Mixed growth data accompanies this sticky inflation backdrop. Economic data in the US has largely exceeded expectations, with the Bloomberg US Economic Surprise Index reaching its highest level since April 2021.

The housing sector, particularly sensitive to interest rates, has shown signs of rebound, as is also evidenced by a 30 percent surge in homebuilder stocks. Conversely, the Eurozone has experienced the worst contraction in the manufacturing sector since May 2020.

In the UK, where food inflation runs rampant at 18 percent and core inflation has reached a record high of 7.1 percent, real GDP growth has averaged close to zero percent in the past four quarters, signalling signs of stagflation.

Meanwhile, the Bank of England has already raised rates by 150 basis points this year to 5 percent, with expectations of further increases to 6 percent. This comes at a time when the nation's government debt-to-GDP ratio has exceeded 100 percent for the first time since 1961.

Emerging markets provide a glimmer of hope

Fortunately, inflation rates in major emerging markets, particularly in Latin America and Asia, have significantly declined. Some of these markets have reached multi-decade highs in interest rates, resulting in attractive real yields (nominal interest rate minus inflation).

As a result, Central European and Latin American currencies have returned between 7.5 percent and 25 percent this year, with the Colombian Peso, Mexican Peso, and Hungarian Forint leading the way.

It is worth noting that Emerging Market central banks had led the rate hike cycle in 2021-22 (India was a relative latecomer in hiking rates) and may provide indications of a rate-cutting cycle heading into 2024.

Not all Emerging Market currencies have benefited, though. Turkey, where inflation remains high at 40 percent (down from a peak of 85 percent in October 2022), has witnessed a 28 percent decline in the Lira this year, exacerbated by President Erdogan's re-election.

Income is making a comeback!

Central banks globally have implemented around 90 interest rate hikes this year, far surpassing the 17 rate cuts. Short-term government bond yields in developed markets have returned to cycle highs, erasing the sub-1 percent rates seen in early 2022.

As a result, fixed income assets have experienced a renaissance. Global short duration investment grade bonds and higher-quality non-investment grade bonds (BB-rated) provide the unique opportunity to generate yields of close to 6 percent to 7 percent in USD terms.

Commodities take a back seat in H1CY23

Cyclical and risk-sensitive commodities such as Energy and Industrial Metals slumped 20 percent and 12 percent respectively in H1CY23. Energy is down 20 percent in H1CY23 after a 36 percent surge witnessed in CT22.

Simultaneously, the sharp declines in grain prices, down 8 percent have all fed hopes of lower global inflation. US Natural Gas prices which rose 26 percent last year have lost 37 percent this year. Brent Crude has dropped 9 percent to $75 a barrel, despite an extension of additional voluntary cuts to production by Saudi Arabia and Russia.

Copper prices have been unchanged this year after falling 15 percent last year as macro-economic data out of China, one of the largest consumers, has been disappointing.

Finally, Gold, the only major commodity to stay in the green this year (+1.8 percent) is also down from its year-to-date peak of $2,077 per ounce to $1,932 per ounce. The move took place on the back of a strong rebound in real yields (inflation-adjusted) which reduces the allure of the non-interest bearing yellow metal.

The takeaway

The H1 2023 has been a period of recovery for financial markets.

Equities rebounded strongly, with the technology sector leading the way. Bonds and income assets experienced a revival on the back attractive yields and headline inflation displaying signs of slowing in developed markets.

The global economic landscape remains mixed, with different regions facing their own challenges and opportunities.

But all of it bears out one eternal truth that in the giant wheel of world markets, just as something goes up something else comes down and usually the laggards of one period become the winners of the next.

(Devina Mehra is the Founder and Chairperson of First Global, a leading Indian and Global investment Management firm. She is a gold medalist from IIMA and has been in the Investment business for over 30 years. She tweets @devinamehra and can be contacted at info@firstglobalsec.com or www.firstglobalsec.com)

(Kavita Thomas and Harsh Shivlani have also contributed to this article)

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!