As Nifty50, the bellwether index inches closer to the psychologically important level of 20,000, investors are wondering whether their equity mutual funds (MFs) will create further value. MFs are seen optimistic and are realigning their portfolios with the changing macro-economic scenario and sectoral fortunes.

Mid-cap, small-cap stocks lead the show

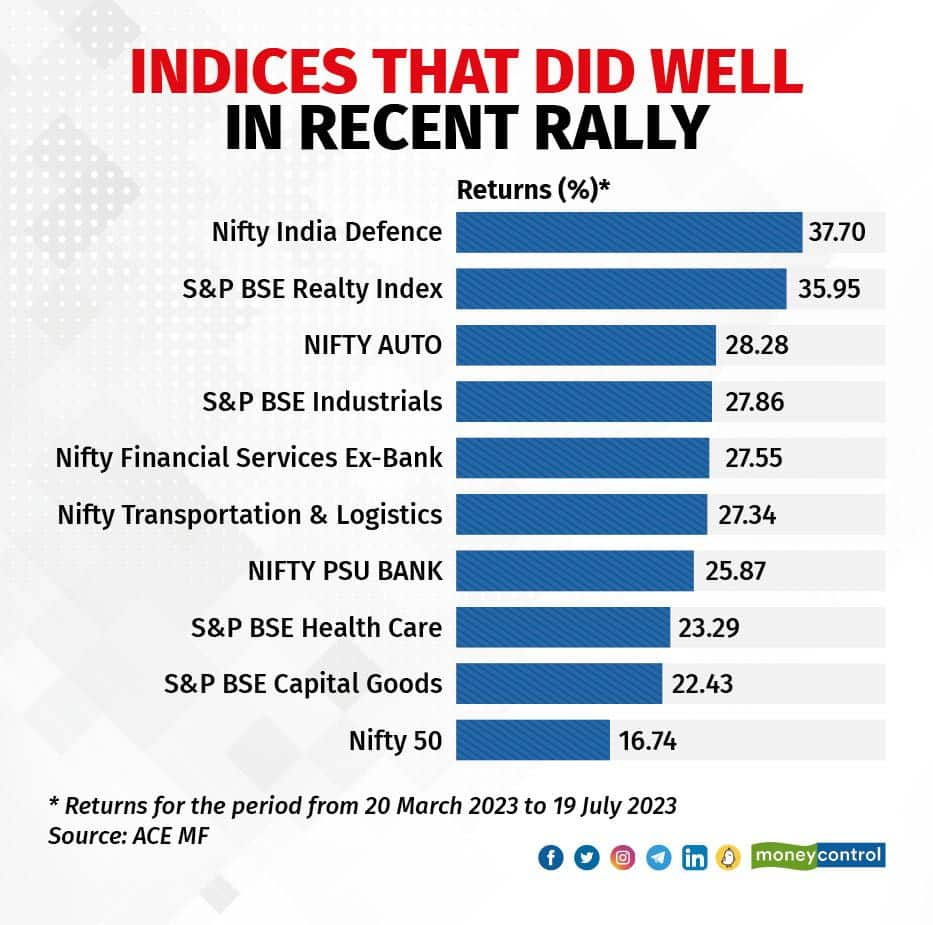

In the beginning of CY2023, stocks were trading in a narrow range, with a downward bias. The Nifty50 hit a low of 16,828 on March 20, 2023. What ensued was a broad-based rally. While the index rose 16.74 percent till July 19, the Nifty Midcap 150 and the Nifty Smallcap 250 did far better, giving returns of 22.44 percent and 25.85 percent, respectively, over the same period.

Investors are seen pouring money into mid-cap and small-cap equities. Small-cap equity funds have received consistent inflows so far. From June 2022, small-cap equity funds have received inflows of nearly Rs 30,000 crore.

Some of the mid- and small-cap stocks have been far outperforming the broader markets since March 2023, on the back of rising interest from domestic investors. Foreign institutional investors (FIIs) prefer large-cap stocks and relatively large-sized liquid mid-cap stocks. FIIs have pumped in Rs 25,121 crore into Indian stocks so far this month, while their investments stood at Rs 55,160 crore in June.

New highs trigger more worries

In this backdrop, when investors wonder if the momentum will continue, new highs add to their worries.

Deepak Chhabria, founder and managing director, Axiom Financial Services, says: “The index will keep climbing new peaks as the economy expands. What matters at this juncture is keeping track of valuations and not chasing over-valued stocks or themes.”

ALSO READ: Does momentum investing strategy work?

The Nifty50 is quoting at a price-to-earnings multiple of 24.09 as on July 19, 2023, compared to 20.18 a year ago. The Nifty Smallcap 250 index is quoting 21.66 as on July 19, 2023 , compared to 20.79 a year ago. Optically, the valuations do not appear too expensive. However, there are some pockets of overvaluations and there are sectors that are considered undervalued. MF managers are busy realigning their portfolios accordingly.

MF portfolios

MF managers have factored in the quick moves in the stock markets. For example, ICICI Prudential Balanced Advantage Fund, the oldest scheme in the category, has cut the net equity exposure to 40 percent in June 2023, compared to 52 percent in March 2023.

MF managers have been selectively realigning their portfolios to benefit from the relative attractiveness of select stocks. For example, in June, MF managers bought stocks of non-banking finance companies (NBFCs), with a view to benefit from a possible fall in interest rates, rising credit demand and relatively better valuations. Select sectors, such as pharmaceuticals, which have underperformed in the recent past, have also seen buying due to the relatively attractive valuations in select sub-segments.

According to Value Research, as on June 30, 2023, large-cap funds, as a category, have the top three largest allocations of 28.16 percent, 11.06 percent and 10.53 percent to financials, consumer staples and energy sector, respectively.

The second-largest sector in Nifty 100 – information technology -- with 11.35 percent weightage, is under-represented in large-cap funds, which have an allocation of 9.68 percent in the sector.

Equity market outlook released by Invesco Mutual Fund emphasises that with a 3-5 year timeframe, Indian equities are becoming one of the best investment destinations.

“Though the mid/small cap space provides a powerful opportunity on the strength of the domestic economy, we expect the present rally to encompass larger swathes of the market in the coming quarters, thereby increasing the attractiveness of the flexicap/large cap segments as well,” it said.

As the dollar index turns weak, anticipating limited rate hikes by the US Federal Reserve, there is an expectation that the money may start flowing into emerging markets, including India. Though there is an expectation that the markets may continue the march upwards, there is always a possibility of correction.

What should you do?

Nitin Rao, CEO, InCred Wealth, says: “There is still some upside left in equities. Long-term investors can continue their investments in a staggered manner. However, if you have been investing for a long time with a financial goal due in the next 2-3 years, you should take some profit off the equity portfolio with a view to protect capital.”

Take a close look at your equity allocation. If your equity portfolio is up significantly, you might have crossed your equity allocation mark. Take some money off the table, in that case. But don’t stop your systematic investment plan (SIP).

ALSO READ: Markets at all-time highs: How retail investors can ride the boom

There is no point making a big move just because the index has made a new high or is about to cross a psychological level. If you are under-invested in equities, or if you are a fresh investor, this is as good a time to invest. But from this point on, make sure you stick around for five years. And where should you invest? Chhabria prefers multi-cap funds and flexi-cap funds through SIPs and systematic transfer plans (STPs). “These schemes require minimum intervention and they are tax-efficient as the fund manager rebalances the allocation to large-, mid-, and small-cap stocks regularly,” he adds.

Though small-cap funds have done well, do not over-invest in them, as they are inherently a more volatile segment of the market, compared to their large-cap counterparts. Chasing hyped stocks or factors such as momentum that has done well in the past, may not be a good idea, if you cannot hold the investment for the long term.

Rao recommends diversified equity funds following ‘value investing’ at this juncture. “Savvy investors should invest in sector funds investing in information technology and pharmaceuticals over the next 3-6 months,” he adds.

A portfolio diversified across asset classes is better positioned to do well as interest rates appear to have peaked.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!