The Club Vistara IDFC FIRST Credit Card is the third card to be loaded with perks for frequent fliers of the airline.

What does it offer?

The card offers several joining benefits, including one complimentary premium economy class ticket voucher, and one class upgrade voucher along with Club Vistara Silver membership. The membership gets you priority check-in and boarding, five kg extra baggage allowance, etc. You will also get a complementary three-month eazydiner membership, which gets you discounts on your restaurant bill.

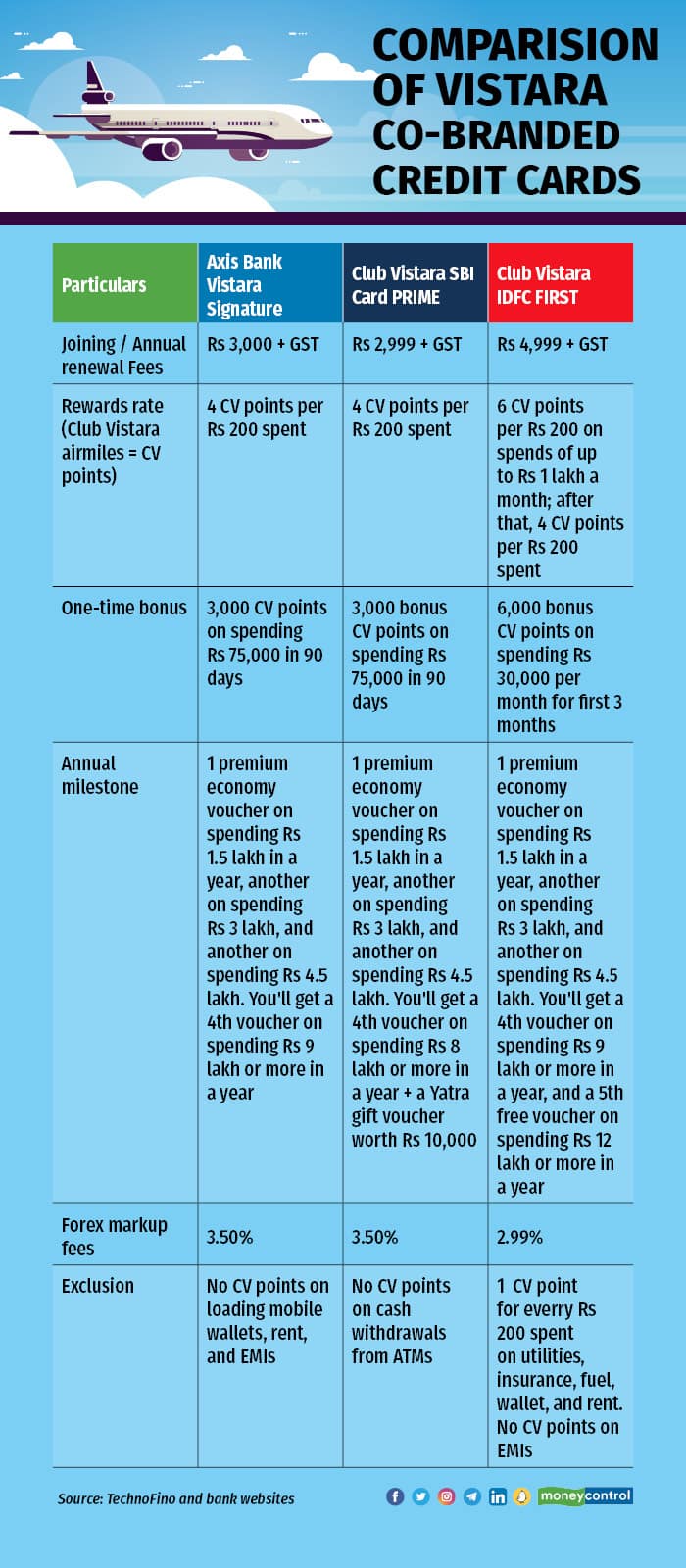

On spending at least Rs 30,000 in a month in the first three months after card issuance, you can earn up to 2,000 bonus CV points (Club Vistara air miles). You will get one premium economy voucher on spending Rs 1.5 lakh in a year, another on spending Rs 3 lakh in the year, and one more if you spend Rs 4.5 lakh. You will get a fourth voucher on spending Rs 9 lakh in a year, and a fifth free voucher on spending Rs 12 lakh or more in a year. Lounge access is not free; you get two visits per quarter at a domestic lounge, and one visit per quarter to an international lounge, if you spend at least Rs 5,000 a month <see table for more benefits>.

The card is offered exclusively on the Mastercard network. The bank’s spokesperson and that of Mastercard did not comment on Moneycontrol’s queries about why this card is exclusively issued on just one network. Recently, the Reserve Bank of India (RBI) had proposed that cardholders must get a choice to select their preferred network. This might get implemented from October 1. Ajay Awtaney, Editor of LifeFromALounge.com says, “This card would have been in development for a while. The circular from the RBI came later. So the stakeholders went ahead with the launch.”

Fees and charges

The card charges a joining / annual renewal fee of Rs 4,999, plus GST. The card also charges an interest rate of 0.75 to 3.5 percent per month unpaid dues; the forex markup is 2.99 percent of the transaction amount.

Simply save podcast | Credit card devaluation – what banks give, they can take away too

What works

Club Vistara has also partnered with Axis Bank and SBI Card for a co-branded travel card, both of which offer goodies for frequent Vistara travellers. “The joining and annual renewal fees of these cards are lower than Club Vistara IDFC FIRST Credit Card,” points out Sumanta Mandal, Founder, TechnoFino, a platform that tracks the Indian credit card industry.

Ankur Mittal, Co-Founder and Chief Technology Officer, Card Insider, another platform that tracks the credit card business, says that the Club Vistara IDFC First credit card is a bit better than the other two, and points to the bonus CV points (up to 6,000) you can earn when you activate the card.

“On the Club Vistara IDFC First credit card you get more air miles, i.e., six points for every Rs 200 spent for the first Rs 1 lakh spent per month, whereas the other two cards in the mid-tier segment give you 4 points for every Rs 200 spent,” says Awtaney. However, after Rs 1 lakh, on the Club Vistara IDFC First credit card too you get 4 points for every Rs 200 spent.

The card also gets you up to five premium economy vouchers on hitting spending milestones, which too is more than what the other two cards offer <see the table for comparison>.

“The forex markup fee on Club Vistara IDFC First credit card is 2.99 percent of the transaction amount, which is lower than both other cards,” adds Mittal.

You are also offered a trip cancellation cover that reimburses up to Rs 10,000 on flight and hotel bookings twice per year.

What doesn’t work

To access the airport lounges, you need a minimum monthly spend of Rs 5,000. This is a major drawback for a credit card with an annual fee of Rs 4,999 plus GST.

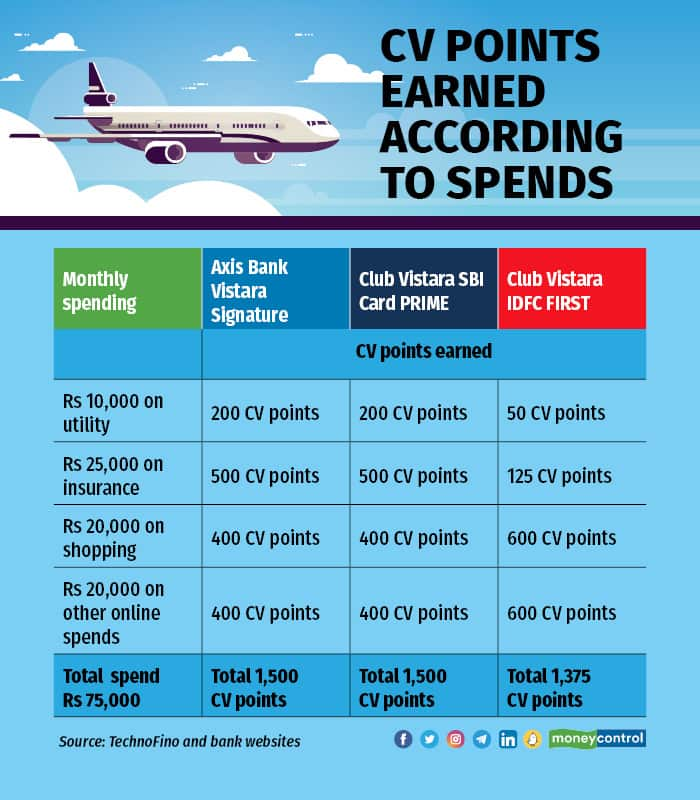

“You get to earn fewer CV points using the IDFC First Vistara Card compared to the Club Vistara SBI Card PRIME,” says Mandal. For instance, you will earn one CV point per Rs 200 spent on utilities, insurance, wallets, rent, and fuel using the IDFC First Vistara Card, whereas with the Club Vistara SBI Card PRIME, you'll earn four CV points per Rs 200 spent on all categories, including utility bills, insurance, fuel, and wallets. <see the table for comparison of CV points earned>

“Using the IDFC First Vistara Card, you can earn one additional premium economy ticket voucher compared to the other two cards. But for that you need to spend more as well,” says Mandal. For instance, to earn four premium economy ticket vouchers, you need to spend Rs 9 lakh annually, and to earn one additional ticket voucher (i.e., a fifth voucher) you need to spend Rs 12 lakh. In contrast, with Club Vistara SBI Card PRIME, you earn four ticket vouchers by spending just Rs 8 lakh annually, and you also receive a Rs 10,000 hotel voucher from Yatra.

Also read | Kotak Mahindra Bank Myntra card offers shoppers a bonanza; But is it worth your time? A Moneycontrol review

Should you apply?

On the IDFC First Vistara Card, you get one complimentary premium economy class ticket voucher and five premium economy ticket vouchers on hitting spend targets, which are higher compared to other cards. You also get Club Vistara membership and class upgrade vouchers. “So, with higher fees, you get more benefits — it’s for the affluent segment. The other two-cards seem to be targeting the mid-income segment with lower annual fees,” says Mittal.

Also, if you’re planning to link your credit card with UPI, then this card might discourage you as it's only available on the Mastercard network. You can do that only on the RuPay network with credit cards of select banks.

However, if you are a frequent Air Vistara flier, then you can see the comparison we’ve done in the accompanying table and consider choosing from among their three co-branded credit cards.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!