On July 21 morning, several Axis Bank credit-card holders got an email from the private lender, saying it had suspended the redemption of their reward points, a big attraction for users. As the news spread, some more Axis Bank customers raised similar concerns on Twitter.

“… a pattern of non-personal usage of your credit card(s) has been observed for the transactions undertaken by you with the following merchant(s), BSPL, Spay Tech Pvt Ltd, Slenpay Pvt Ltd, etc,” the email, a copy of which was reviewed by Moneycontrol, said.

As per the bank’s policies, the credit cards can only be used for “your personal expenses and purposes, and any other transaction (including for business and commercial purposes) is prohibited under the Axis Bank’s card member agreement... ” the mail said.

The mail suggests that the bank noticed users spending money on expenses that are not usually allowed as they earn reward points unfairly.

“Business spends on personal credit cards are against terms & conditions and Axis Bank seems to have targeted users with transactions on specific payment gateways that are used for Business Payments,” said Tejas Ghongadi, Co-Founder, The Points Code.

The Points Code is a platform that helps credit-card users get maximum benefits from credit-card rewards and redemptions.

Axis Bank's decision to block access to redeem reward points for some users engaged in non-personal spending is a commendable step towards maintaining the sustainability of its rewards programme, said Ankur Mittal, co-founder and chief technology officer, Card Insider, a platform that tracks credit-card business.

“By preventing misuse of personal cards for business expenses, the bank ensures that genuine users can continue benefiting from the rewards,” Mittal said.

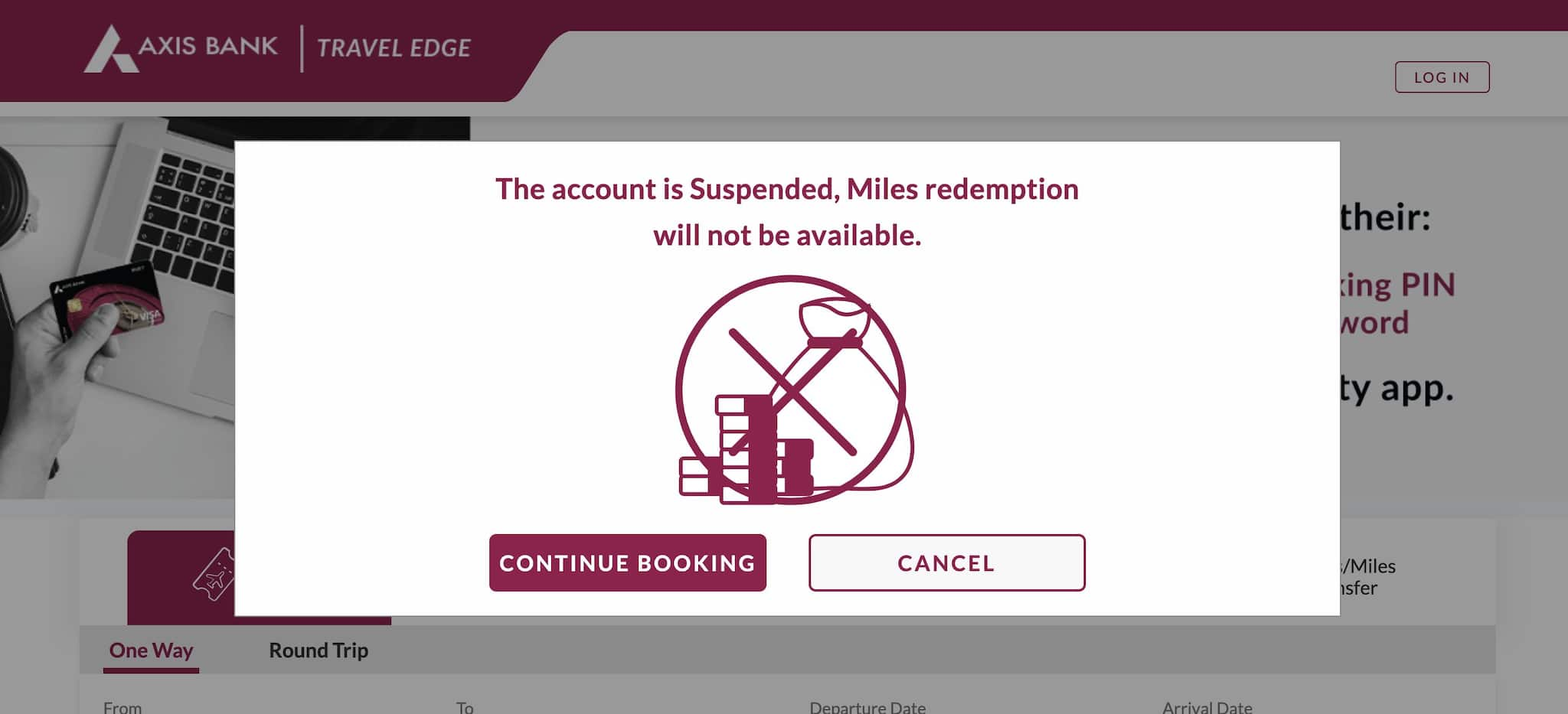

Source: Axis Bank

A history of blocking cards?

Experts who track credit cards say that Axis Bank keeps a close vigil on suspicious spending patterns. In March 2023, it sent suspected commercial use notifications to the high-networth individuals (HNIs) holders of cards such as Axis Magnus and Axis Reserve.

“The bank also has a history of canceling the cashback cards such as Axis Ace and Flipkart Axis Bank credit card if they were found used for business purpose,” said Sumanta Mandal, Founder, TechnoFino, a platform that tracks the Indian credit card industry.

Moneycontrol reviewed one such email that a customer received early this year where the bank asked invoices or proof to prove that all the transactions done in December 2022 and January were for personal use only. Failing which, the bank warned of blocking the cards.

Similarly, in June 2023, the bank informed some customers that their cards were blocked and reward redemption suspended temporarily, as they were suspicious of using them for business purposes, Mandal said.

Moneycontrol couldn’t independently verify the veracity of these emails.

“While it may be a good idea to prevent misuse, there are reports of genuine spenders also receiving such notices, which is concerning,” Mandal said.

Ghongadi said some people were gaming the system to make money or earn reward points without actual spends, which is an unethical practice.

Also read | Higher fees, lower reward points: Axis Bank cuts back on Magnus, Reserve credit card benefits

Non-compliance with terms, conditions

While applying for a credit card, a customer agrees to certain terms and conditions set forth by the issuer. If these are violated, the issuer can cancel the card.

“This could include using the credit card for illegal activities such as for gambling, money laundering, using the personal credit card for business transactions, or providing false information on the credit card application,” Mandal said.

To avoid this mistake, read and understand the terms and conditions of your credit card. Utilise your personal credit card only for personal expenses and refrain from using it for any business-related expenses or reselling goods.

Also read | Axis Bank reduces benefits on Flipkart Axis Bank Credit Card

What should you do if your rewards have been suspended?

If you receive such an email from the bank or the credit card company, you must try and produce invoices of goods and services you paid for through the card.

Typically, the bank sends a weblink, allowing users to submit invoices, online. The proofs have to be submitted within 30 days of getting the mail. You can also use phone banking to get in touch with your bank.

Also read | Higher spending, missed payments? Your credit card may be cancelled

Keep personal and business separate

Experts say it is not a good idea to mix business and personal expenses on your personal credit card. Personal credit cards are meant for personal use and the benefits and rewards are optimised based on individual usage.

“Most issuers have separate business credit cards that are specifically optimised for businesses and have better rewards and benefits for business users,” said Adhil Shetty, CEO, BankBazaar.com.

Proper use of a business credit card helps build business credit and also offers a chance to earn additional rewards and benefits.

Many banks draw a strict line between personal and business use of a personal credit card and outline them in their terms and conditions. Others do not have it mentioned but may flag excessive use for business purposes.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!