Highlights

The results reflect the improved performance of Sirpur Paper Mills (SPM), which was acquired in FY22. Also, higher volume and net sales realisation (NSR) in the writing & printing (W&P) segment partially offset the muted packaging board business.

Volume growth is expected to improve, and will drive top-line growth in the current fiscal.

The management foresees market share gains on account of higher capacity utilisation from the segments added in the last fiscal (corrugated box business), and believes that the change in product basket and lower raw material costs will keep margins steady in the coming quarters.

Q1FY24 Update

Organic expansion and new business aided volume growth

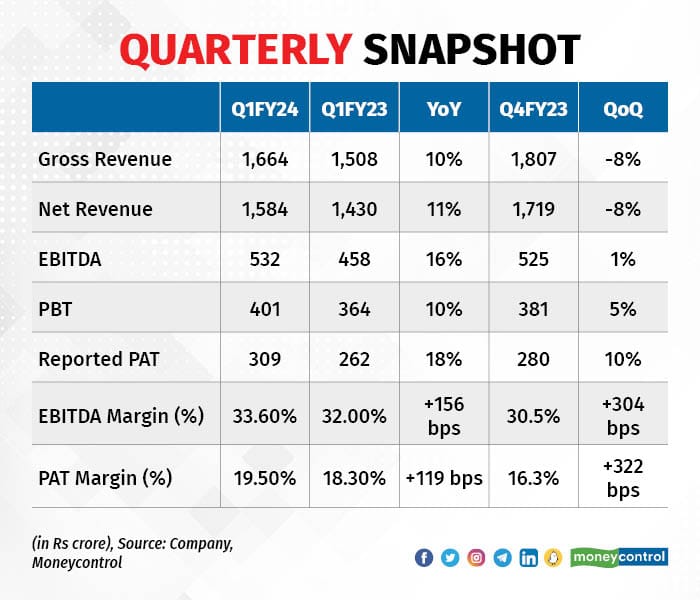

Although volumes improved in the W&P segment, backed by higher demand for uncoated paper and improved capacity utilisation, subdued demand in the packaging board business (volume down by around 5-7 percent) led to a decline in the overall top line on a quarter-on-quarter (QoQ) basis (down 8 percent) in Q1.

The newly acquired corrugated box business (December 2023) contributed around 10 percent to the top-line growth in Q1, according to the management.

The company will strive to utilise the additional capacity from the corrugation business to reach optimal levels. The utilisation is expected to improve to 70 percent in FY24 (from 60 percent in FY23).

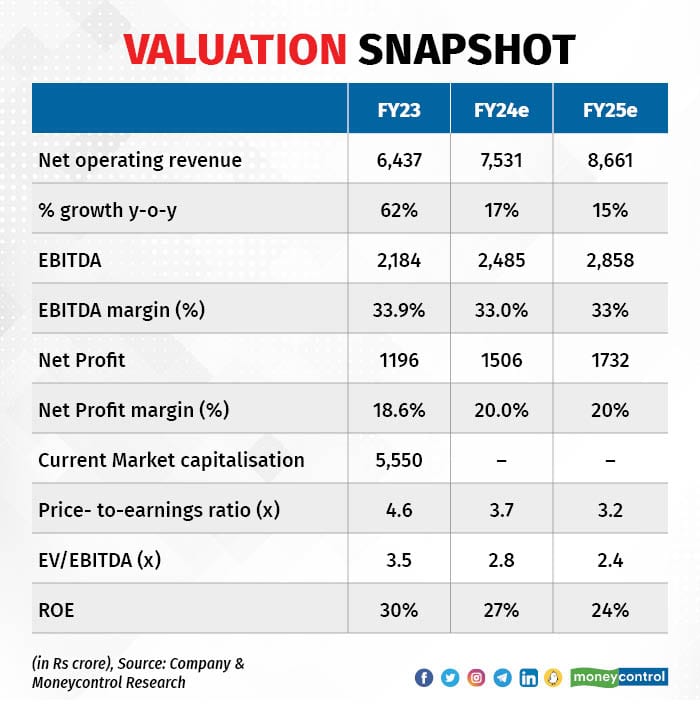

Total revenue from the paper business is guided to be range-bound between Rs 6,500 crore and Rs 6,700 crore. After adding revenue contribution from the corrugated business, total consolidated revenue is expected to increase to around Rs 7,500 crore in FY24.

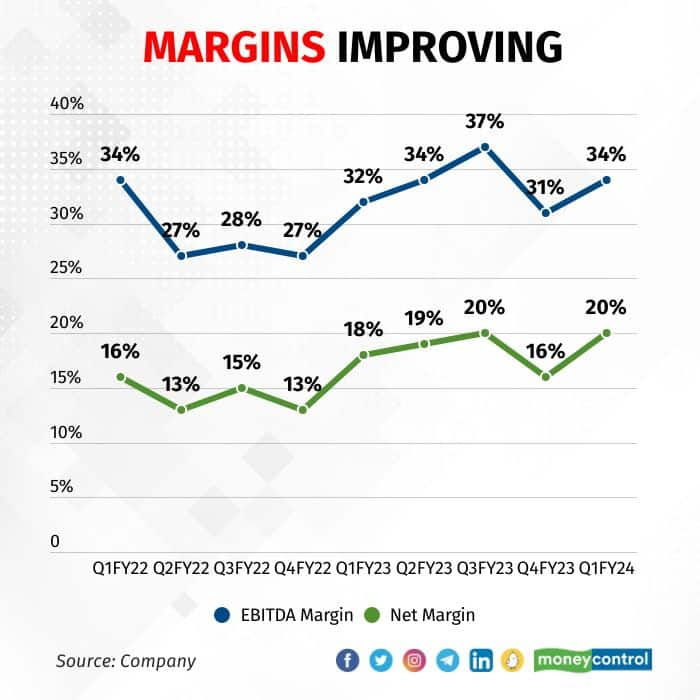

Sharp rise in margins on higher prices and easing input cost

The EBITDA margins saw a sharp sequential improvement in Q1 (up 304 bps QoQ to 33.6 percent), primarily driven by higher capacity from the corrugated box business and SPM, where capacity utilisation increased to 94 percent in Q1.

This more than offset the lower prices in the packaging board (down by around 7-10 percent in Q1) and coated paper (down 20 percent) segments.

The continuous downward trajectory in pulp prices, coupled with lower fuel costs, will keep margins steady in the coming quarters. The full impact of price drop will be visible in margins in H2FY24, primarily in the packaging board business.

The company is mulling investment of Rs 650 crore in the new pulp plant, of which Rs 400 crore will be funded through internal accruals, and the remaining via long-term debt.

The project is expected to be commissioned by Q2FY25, and will further improve the overall manufacturing costs.

Packaging board division outlook encouraging

The market conditions have been challenging on account of excess capacity and weak demand from the pharma and FMCG sectors, which also led to lower prices. However, demand is expected to improve before the start of the festive season from mid-July, according to the company.

Prices have bottomed out, and the management is confident that NSR will improve from H2FY24, backed by stable demand growth.

According to industry experts, the installed capacity in the packaging paper division was at par with the publication capacity in FY23 and it will surpass the same from FY24.

Moreover, single-use plastic ban is largely going to benefit the packaging paper sector, providing it immense opportunities to grow sustainably over the long term.

Outlook and valuation

JK Paper is a backward-integrated player with a well-diversified product mix. In terms of market share, the company is close to 30 percent in the copier segment, and it is expected to maintain its leading position.

Moreover, after capacity addition, the market share has improved to around 20 percent in the packaging board segment, and should inch up, going forward.

According to industry experts, growth in the paper sector will be range- bound between 4 and 5 percent, supported by the education segment, which accounts for over 60 percent of the total demand.

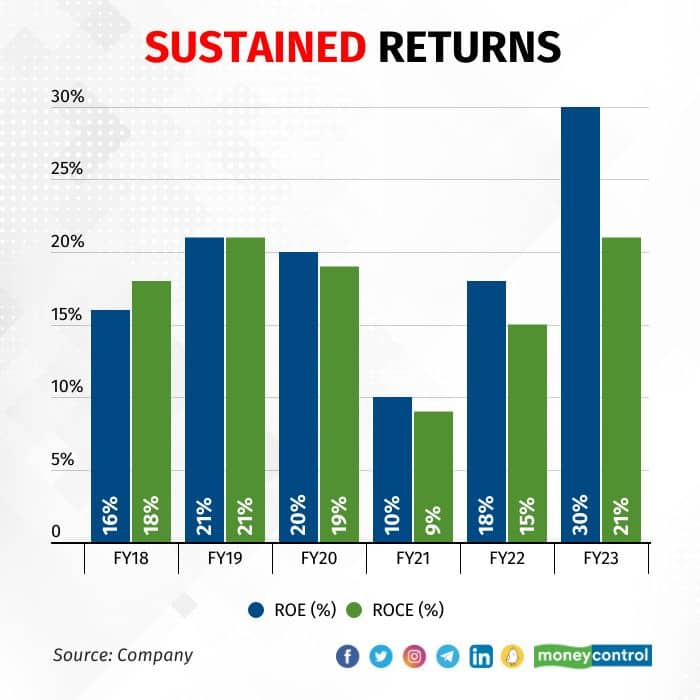

JK Paper is trading at 2.4 times EV/EBITDA and 3.2 times on a P/E basis, estimated for FY25e. This is attractive, considering the company’s market leadership position and strong return on equity (RoE at 30 percent in FY23).

JK Paper endeavours to be a benchmark company in the paper and pulp industry. We believe there is value for long-term investors on account of strong earnings and continuous innovation to enhance product quality.

For more research articles, visit our Moneycontrol Research page

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Cipla, Dr Reddy’s deliver a pep pill for pharma stocks

Jul 27, 2023 / 03:58 PM IST

In today’s edition of Moneycontrol Pro Panorama: New Delhi needs strategic approach towards China, Colgate brings cheers to inve...

Read Now

Moneycontrol Pro Weekender: Climbing Mount 20k

Jul 22, 2023 / 10:00 AM IST

Emerging markets are in the spotlight as the shift in foreign capital flows has been driven by disappointment about China’s reco...

Read Now