The recent addition to frequently asked questions on personal finance is whether to invest or subscribe to the National Pension Scheme (NPS) or not.

The government of India introduced this scheme in 2003 for government employees, with an objective to reduce the dependence on the exchequer to provide pension to individuals.

Subsequently, it was made available to all categories of employees.

NPS is a voluntary, defined contribution retirement savings scheme designed to help the subscribers make optimum decisions regarding their future through systematic savings during their working life.

It seeks to inculcate the habit of saving for retirement. It is an attempt at building adequate retirement income.

Under NPS, individual savings are pooled into a pension fund which are invested by professional fund managers into portfolios, comprising government bonds, corporate debentures and equity shares.

These contributions would accumulate over the years, depending on the returns earned on the investment.

At the time of normal exit from NPS, subscribers may use the accumulated pension wealth under the scheme to purchase a life annuity from a Pension Fund Regulatory and Development Authority (PFRDA)- empanelled life insurance company, apart from withdrawing a part of the accumulated pension wealth as lump sum, if they so choose.

Salient features of the scheme

1. Eligibility: All employees aged 18 years and above.

2. Voluntary: It is not compulsory and employees can also exercise the option of contributing more under NPS Tier 2 scheme.

3. Investment level: Low. Minimum 6,000/year

4. Cost: Despite investing in market-based instruments, it has the lowest expense ratio.

Key reasons why investors like to invest in NPS

· Rs 50,000 of additional tax benefit (over & above 150k)

· On maturity, entire proceeds are tax-free

· Option of selecting equity as an asset class

What the fine print says

· Of the maturity amount, only 60 percent as lumpsum is tax-free. At least 40 percent has to be compulsorily invested in an annuity scheme and the balance is taxable.

· The periodic annuity received is taxable at a marginal tax rate (currently, it is at 6.2 percent, and after tax, it would be ~4.5 percent for individuals in the 30 percent tax bracket)

· Maximum amount that can be invested in equity is 75 percent.

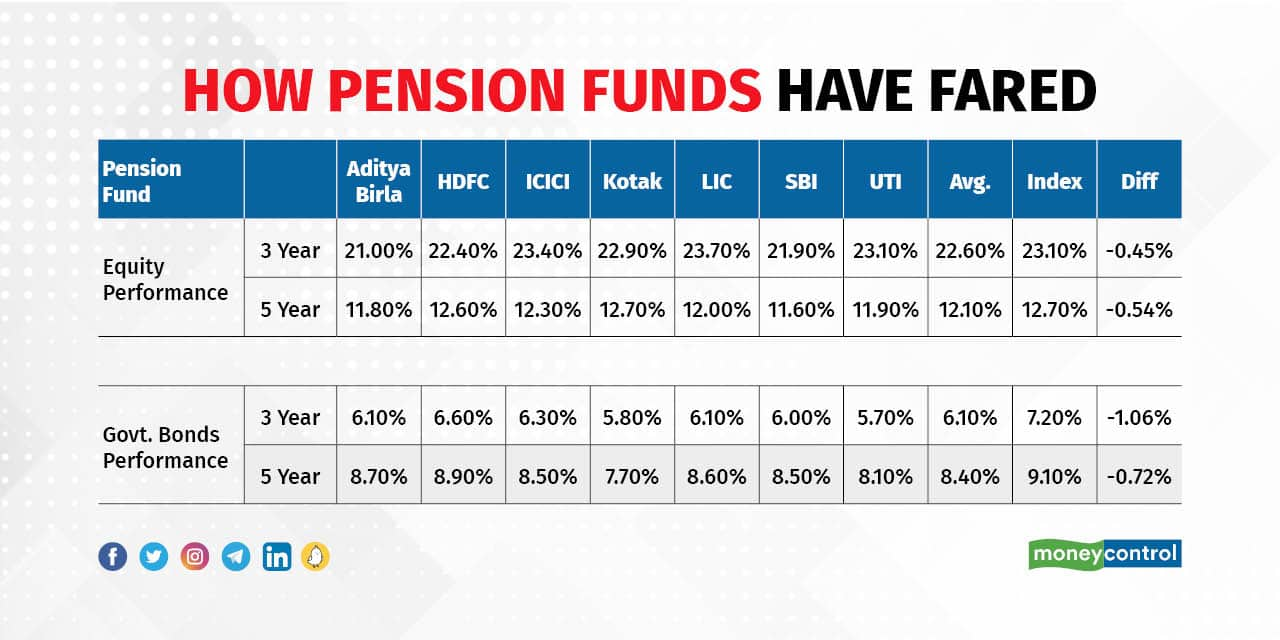

· NPS fund has delivered lower returns than their benchmark indices - both in equity and debt to the extent of 0.5 - 1.0 percent across tenures.

How NPS fares against equity index funds and VPF

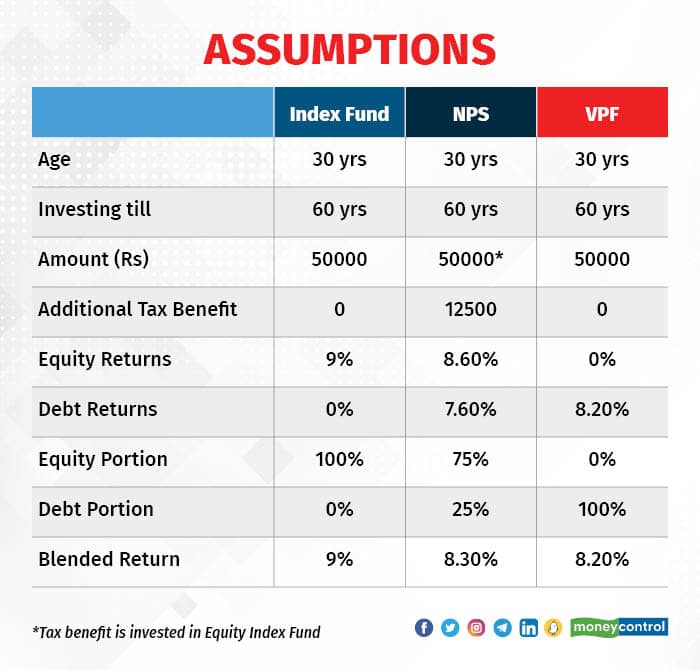

To facilitate the ease of decision making, we have compared NPS along with an Equity Index Fund as well as Voluntary Provident Fund (VPF). The following are the set of assumptions for each of the investment instruments.

We have assumed a blended tax rate of 25 percent due to exemptions under 80C, deductions and certain benefits like home loan interest, reimbursements, etc.

For VPF subscribers, we are assuming that the individual is already claiming tax benefits through other avenues, and, hence, no incremental tax benefit is factored in.

For NPS investors, we assume that the savings thus made available is reinvested in an equity index fund. Similarly at age 60, the VPF maturity amount is invested in an equity index fund. The NPS equity returns are assumed to be lower than the benchmark returns by 40bps, in line with the prevailing underperformance over longer tenures.

We have assumed a 10 percent long-term capital gains tax on 20 percent of NPS maturity corpus. On 40 percent of annuity corpus, we are assuming 6.2 percent returns, which is taxed @25 percent. The remaining 60 percent amount is assumed to be invested in an equity index fund.

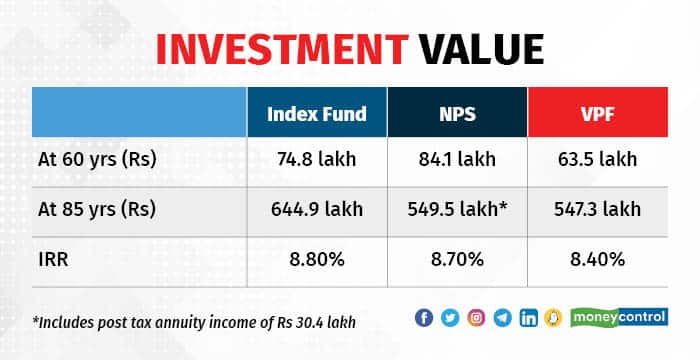

The following is the snapshot of the build-up of investment at age 60 as well as 85 (assumed life expectancy rate of an individual who is 30-year-old now).

Also read: NPS assets at Rs 9 lakh cr, subscriber base at 6.3 cr as of March 2023: PFRDA

From the above table, it is evident that NPS corpus at age 60 is higher than both equity and VPF.

However, requirements like compulsory annuity investment and taxation on more than 60 percent withdrawal impact NPS’ subsequent returns.

As a result, investing in an equity index fund provides better returns, both from the quantum as well as the IRR (internal rate of return) perspective. Even VPF (voluntary provident fund) grows into a corpus similar to NPS, despite yielding a lower IRR.

Also, the biggest advantage of both index funds and VPF is the flexibility to invest the corpus on maturity at 60. For example, an individual can invest the maturity corpus in a senior citizen’s scheme, which currently provides 8.15 percent returns, compared to 6.2 percent via annuity schemes.

In summary, NPS can be a viable investment option for retirement planning, considering the tax benefits and asset mix. However, investors need to evaluate the tax implications and future returns, especially regarding annuity investment and withdrawal policies, to make an informed decision based on their financial goals and risk appetite.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Cipla, Dr Reddy’s deliver a pep pill for pharma stocks

Jul 27, 2023 / 03:58 PM IST

In today’s edition of Moneycontrol Pro Panorama: New Delhi needs strategic approach towards China, Colgate brings cheers to inve...

Read Now

Moneycontrol Pro Weekender: Climbing Mount 20k

Jul 22, 2023 / 10:00 AM IST

Emerging markets are in the spotlight as the shift in foreign capital flows has been driven by disappointment about China’s reco...

Read Now