Highlights:

With travel picking up, government efforts to boost connectivity as well as India hosting key international events, demand momentum should remain strong. IHCL expects the uptick in average room rates to continue.

IHCL, with a comprehensive product portfolio, leading position in the industry as well as a strong balance sheet (debt free at net level), is well positioned to capitalise on the increased travel demand.

June 2023 quarter results

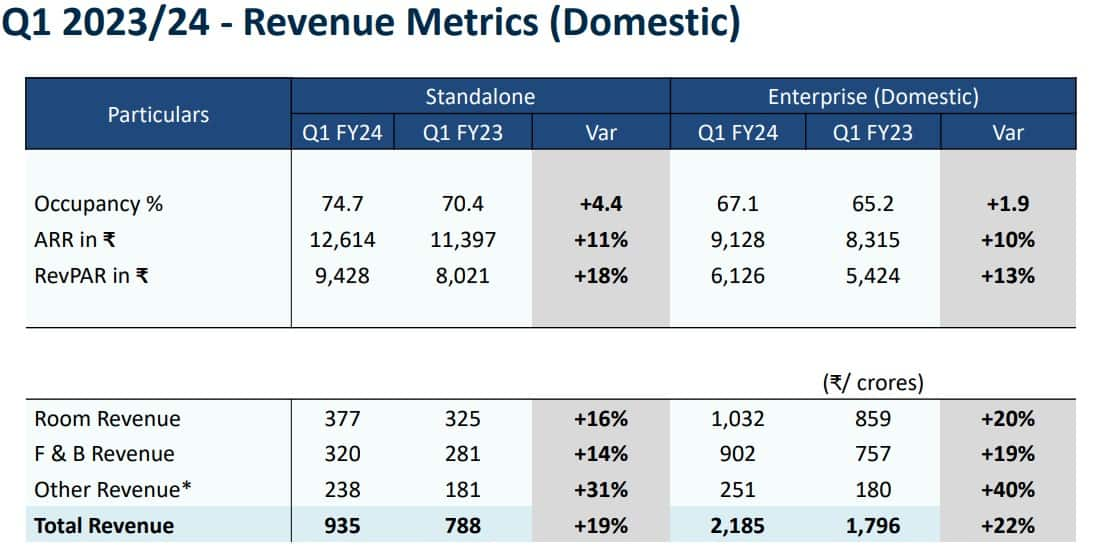

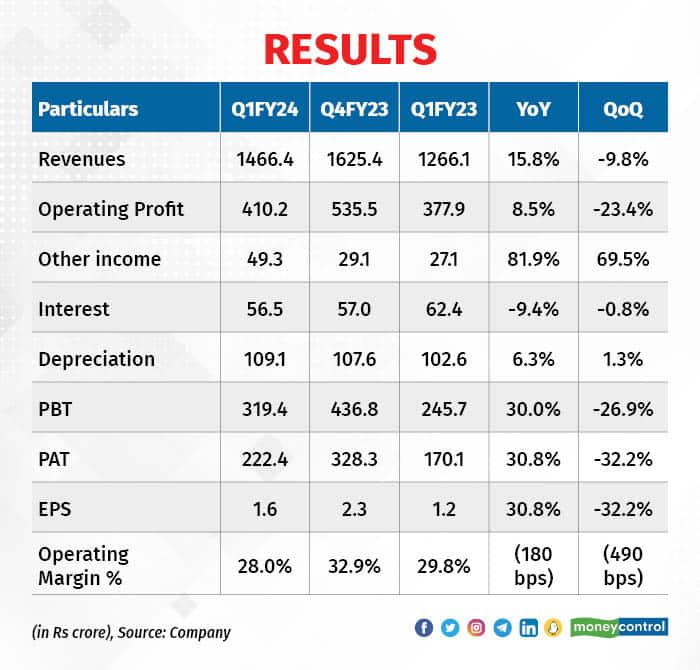

Revenues grew strongly 16 percent year on year (YoY). Domestic business (about 77 percent of the revenues) grew 17 percent while international operations grew by about 18 percent.

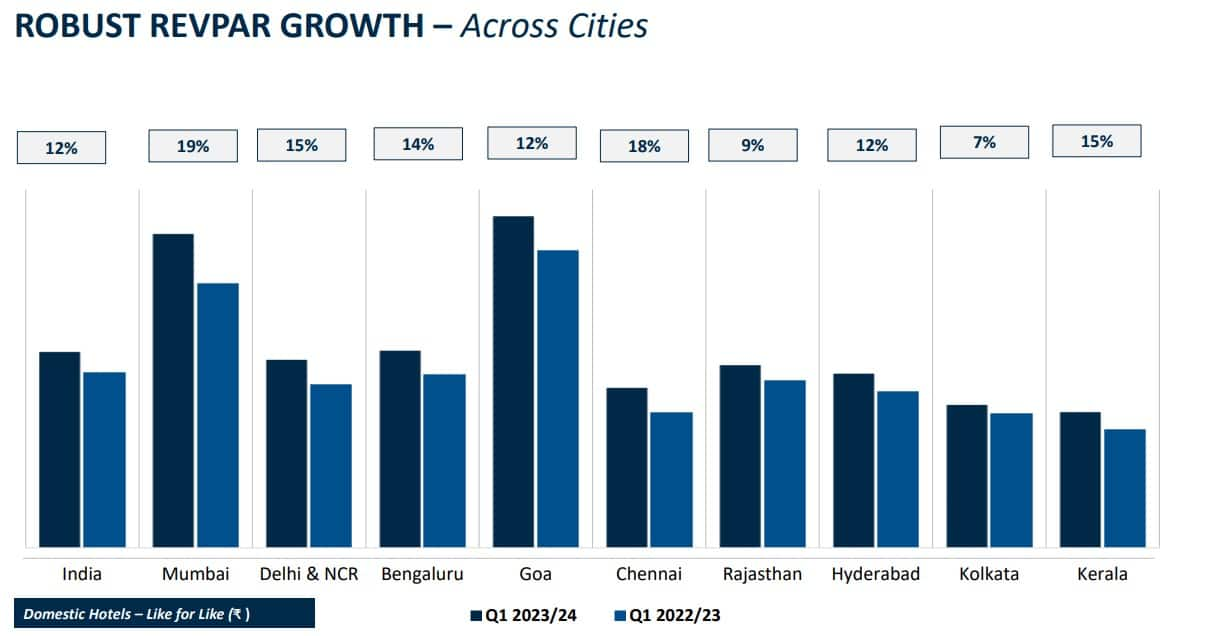

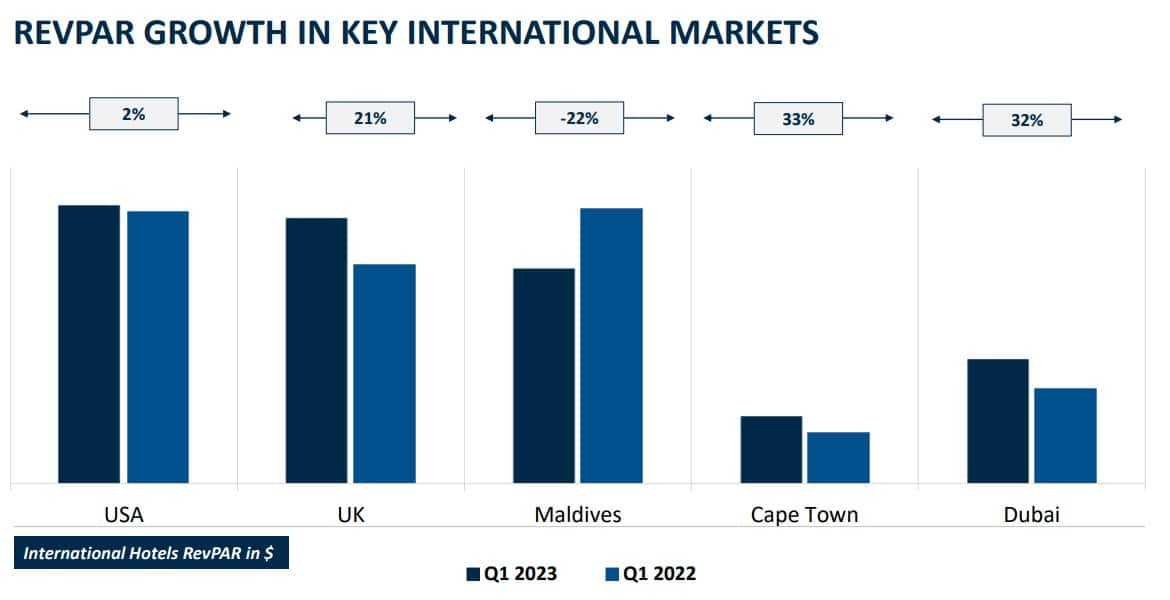

Domestic business RevPAR (revenue per available room) grew by 18 percent. Like-for-like Revpar growth for the domestic business stood at 12 percent. For international business, barring the US, all other markets reported robust RevPAR growth.

Source: Company

Source: Company

Source: Company

Earnings before interest, tax, depreciation and amortisation (EBITDA) margins declined by about 200 bps, led by increased employee and other expenses. Also increased marketing expenses to promote new businesses increased costs. Higher other income and lower interest expenses (owing to debt repayment) completely offset the impact of decline in margins. Net profit grew 31 percent YoY.

IHCL generated free cash flows worth Rs 47 crore during the quarter.

Demand momentum expected to remain strong

IHCL witnessed healthy double-digit Rev Par growth in Q1FY24. With key events, such as the ongoing G20 meeting (witnessing arrival of foreign delegations from various countries), as well as the upcoming Cricket World Cup in India, hotel industry demand is expected to remain strong.

Further, international travellers are expected to come back in full swing this year, after 2-3 years of COVID-related disruptions which would aid in demand momentum.

Also, the government plans to promote tourism on a mission mode. Eighty new airports are expected to be added over the next five years. This would significantly improve connectivity and boost tourism.

The government is also enhancing e-tourist visa facilities to facilitate tourism. IHCL expects hotel industry demand to remain strong over the next few years.

Robust inventory addition plans

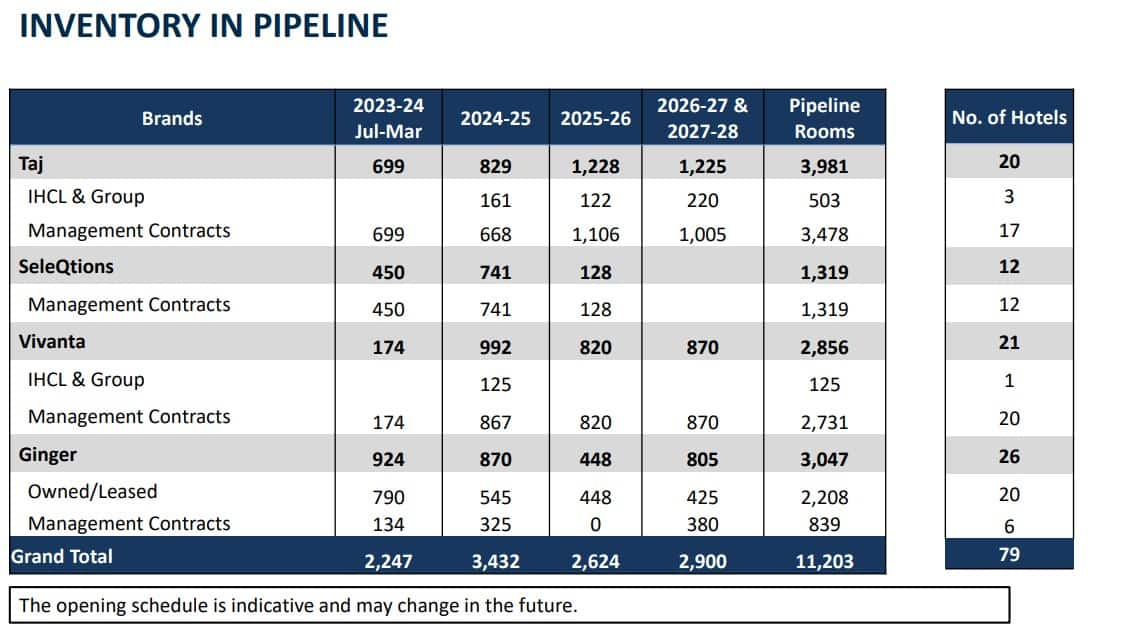

In order to capitalise on the strong demand scenario, IHCL plans to add about 11,000 rooms over the next 4-5 years (current count of close to 22,000 rooms). The room additions are planned across portfolios. About three-fourths of the incremental room additions would be via the asset-light management contract route. This would enable a robust expansion without stressing the balance sheet.

IHCL stated that while expansion in the domestic market would remain the key focus area, it would selectively expand in international markets. During the quarter, IHCL approved acquiring 100 percent equity of Pamodzi Hotels, Zambia, for an enterprise value of $15 million and entered into a lease agreement for a proposed hotel in Frankfurt, Germany (capex for renovation would be 5 million euros).

Source: Company

Scaling up new businesses; focus on Chambers business

Q-Min, the culinary business which was commenced during COVID-19, has reached 40 outlets (half of them in Ginger hotels), establishing its presence in 19 cities.

Q-Min GMV (gross merchandise value) has reached Rs 170 crore since inception. Ama (bungalow stays) has opened more than 125 properties spread across 50 locations. IHCL is also focusing on increasing the high-margin Chambers business. It added 50 new members in Q1FY24, taking the overall count to 2,650 (business accounted for Rs 28 crore revenues in Q1).

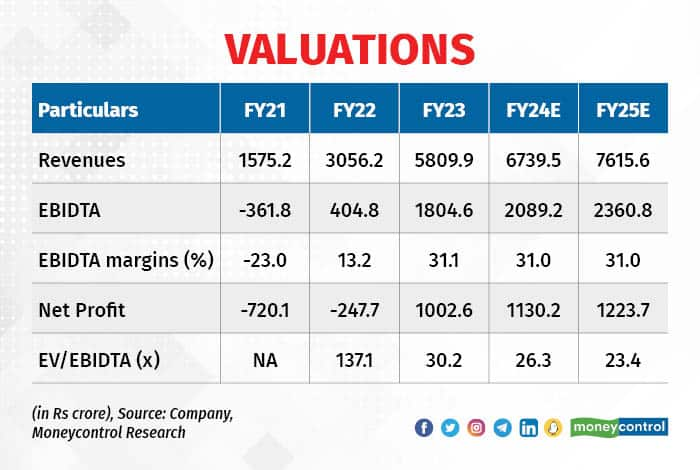

Valuations

At the current market price, the stock is trading at an EV/EBIDTA of 23 times FY25 projected estimates. Investors with a long-term view can look to add the stock on declines.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Cipla, Dr Reddy’s deliver a pep pill for pharma stocks

Jul 27, 2023 / 03:58 PM IST

In today’s edition of Moneycontrol Pro Panorama: New Delhi needs strategic approach towards China, Colgate brings cheers to inve...

Read Now

Moneycontrol Pro Weekender: Climbing Mount 20k

Jul 22, 2023 / 10:00 AM IST

Emerging markets are in the spotlight as the shift in foreign capital flows has been driven by disappointment about China’s reco...

Read Now