Highlights

Premium growth higher than industry growth

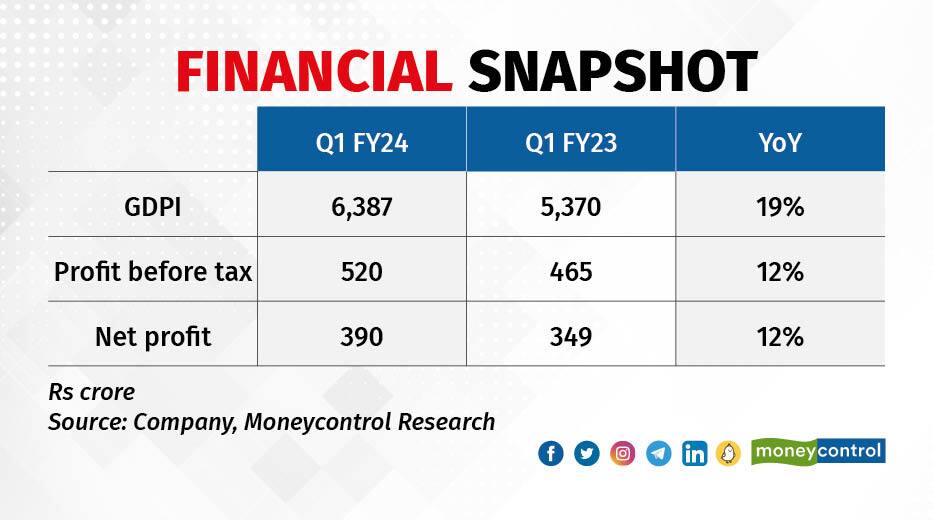

ICICI Lombard’s growth in GDPI (gross direct premium income) at 18.9 percent in Q1 FY24 was tad above the industry growth of 17.9 percent in the same period. Excluding crop, the GDPI growth of the insurer was at 19.2 percent, which was higher than the industry growth of 17.4 percent in Q1 FY24.

Weak motor insurance business

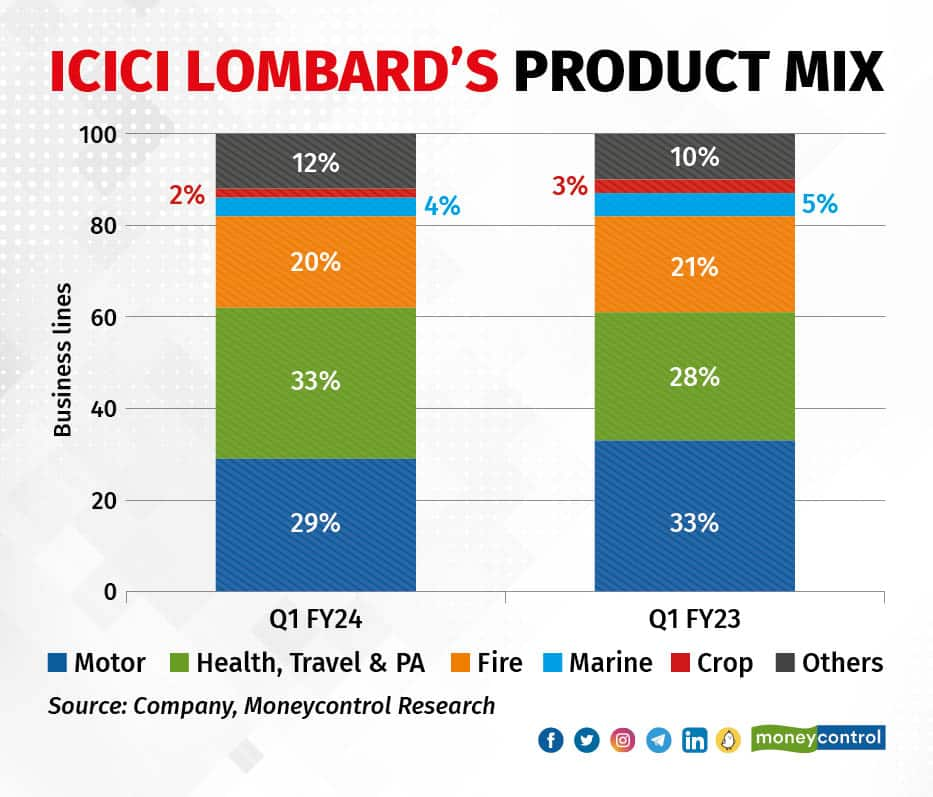

ICICI Lombard continues to lose market share in the motor segment. The insurer’s GDPI growth was dragged down by a tepid growth of 5.3 percent in the motor insurance segment in Q1 FY24.

There was no revision in the base premium for the TP (third-party) motor segment by the regulator for FY24. Since more than a year, ICICI Lombard has been readjusting its motor vehicle portfolio away from private cars, given the pricing competition. Instead, it is focused on growing the CV (commercial vehicles) and the two-wheeler (TW) segments. Accordingly, the proportion of TW in the motor insurance mix improved to 30.3 percent in Q1 FY24 compared with 27.7 percent in Q1 FY23. This is despite the fact that TW sales for the quarter, in terms of volume, remained below the pre-pandemic levels as per SIAM data.

Good traction in the P&C segment

In the property and casualty (P&C) business, ICICI Lombard grew at 17 percent — higher than the industry growth of 7.8 percent — during the quarter. The insurer gained market share across all the segments such as Fire, Marine, Engineering, and Liability.

Within P&C, the fire market saw some rate pressures but the inherent growth remained intact. The focus of the government on infrastructure led to a 41.3 percent growth in engineering during Q1 FY2024 and is expected to show encouraging growth in the future as well.

Robust growth in health business

Health insurance was the largest contributor to overall growth. ICICI Lombard’s health insurance premium grew at 40.4 percent, which was higher than the industry growth of 20.7 percent.

Within health, the group health business grew by 44 percent during the quarter.

To capture the opportunity in the retail health segment, ICICI Lombard has been increasing its distribution network by adding retail health agency managers. This investment in the retail health side resulted in a retail premium growth of 22.8 percent YoY in Q1 FY24, outpacing the industry growth of 18 percent in the same period.

The insurer expects the growth to accelerate in the next few quarters as the sales force starts getting productive. The insurer undertook a price increase in the retail health indemnity renewal book of around 19 percent in February.

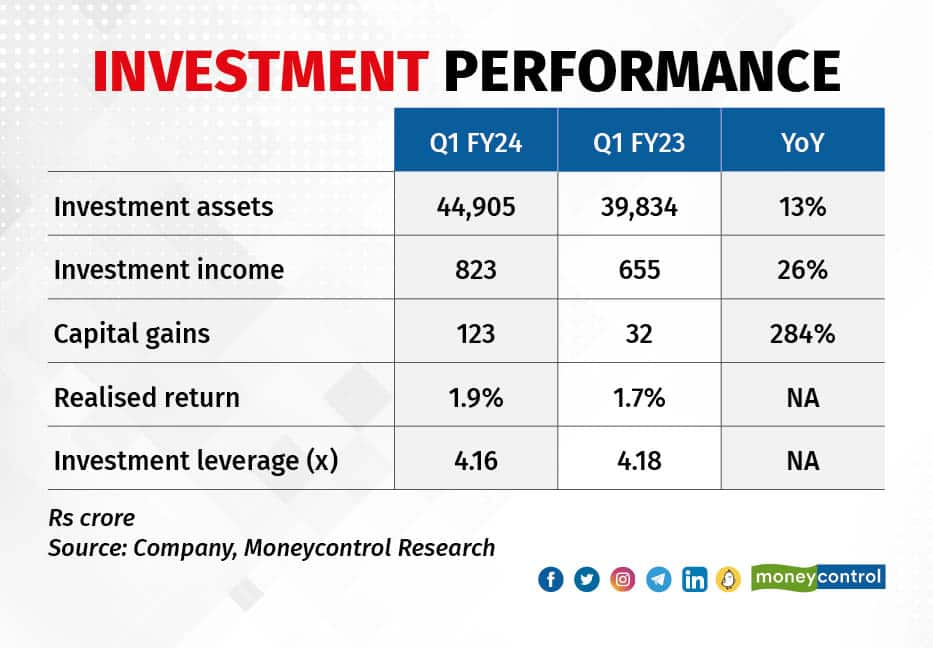

Underwriting loss offset by investment income

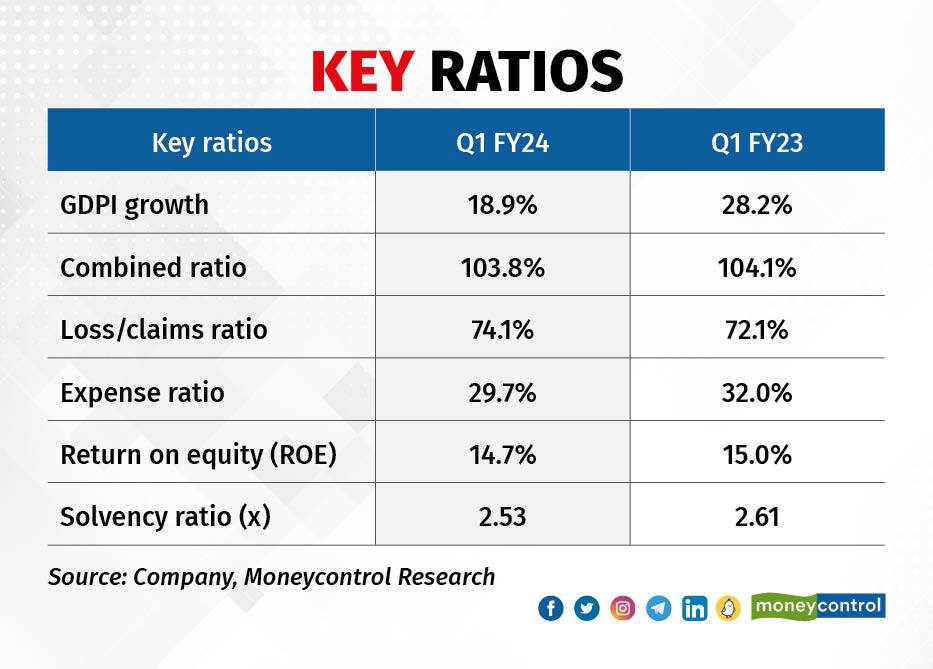

ICICI Lombard’s combined ratio trended downwards to 103.8 percent in Q1FY24. Excluding the impact of cyclone losses, the combined ratio was 102.9 percent for Q1 FY24. For a general insurer, lower the combined ratio, better the profitability.

The combined ratio is the sum of the loss/claims ratio and the expense ratio. While the expense ratio declined, higher claims in crop and P&C led to a higher loss/claims ratio.

The management had earlier indicated that the combined ratio could move down in FY24 as all investments made in enhancing the distribution channel will start yielding results and will start getting reflected in the form of lower expense ratio in the future.

Valuation premium justified by superior franchise and sector tailwinds

At the current market price of Rs 1,350, ICICI Lombard is trading at a valuation of 6 times the book value as of June which is undoubtedly rich.

While the ROE (return on equity) has moderated to 15 percent from above 20 percent a couple of years back, there are many levers for improvement. One of the key catalysts will be the growth in the health business.

Health is a relatively profitable segment as it has lower claims/loss ratios compared to motor insurance. The favourable shift in ICICI Lombard’s product mix in favour of health insurance augurs well for future profitability. Within the health segment also, ICICI Lombard expects higher traction in individual health indemnity products in the future which has a much lower loss ratio compared to group health policies. Standalone health insurers (SAHIs) have regulatory advantage as the aggregate EOM (expense of management) limit for multiline insurers (ICICI Lombard) is 30 percent, while it is 35 percent for SAHIs (Star Health) from April 1, 2023. But given that ICICI Lombard’s market share in retail health business is a mere 3 percent (compared to over 30 percent for Star Health and over 9 percent for HDFC ERGO), there is a long runway for growth.

Overall, ICICI Lombard’s premium valuation will not only sustain but the stock price will move up with improving return ratios. Long-term investors can add the stock.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Cipla, Dr Reddy’s deliver a pep pill for pharma stocks

Jul 27, 2023 / 03:58 PM IST

In today’s edition of Moneycontrol Pro Panorama: New Delhi needs strategic approach towards China, Colgate brings cheers to inve...

Read Now

Moneycontrol Pro Weekender: Climbing Mount 20k

Jul 22, 2023 / 10:00 AM IST

Emerging markets are in the spotlight as the shift in foreign capital flows has been driven by disappointment about China’s reco...

Read Now