Foreign inflows have had a big role in the Indian market’s recent record-breaking sprint but they cut stake in the big information technology players in the June quarter, the latest shareholding patterns show, as the IT sector grapples with global economic uncertainty.

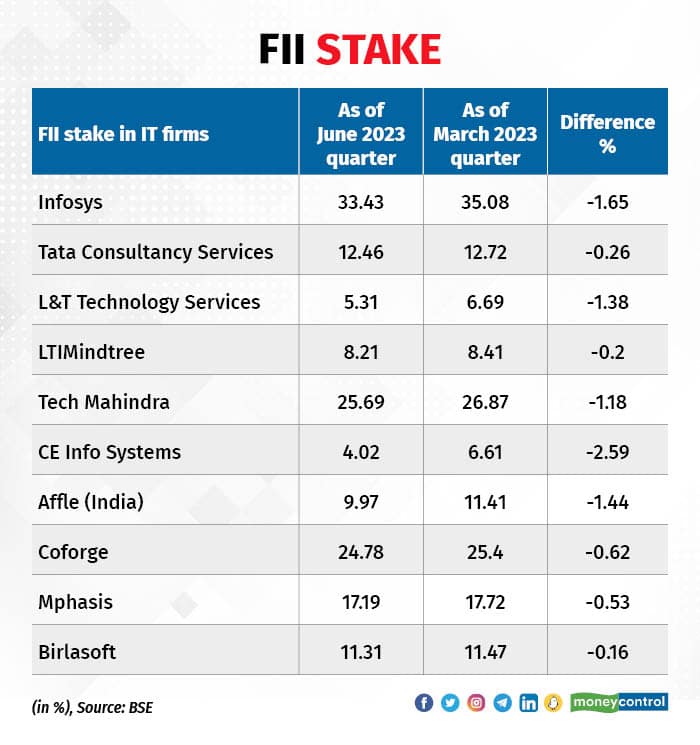

Foreign institutional investors (FIIs) reduced their stake in Infosys, India's second-largest software services firm, to 33.43 percent in the June quarter from 35.08 percent in the previous quarter. This marks the second consecutive quarter that FIIs reduced stake in the Bengaluru-based company.

Sharing its June quarter earnings, Infosys slashed its revenue guidance for FY24 to 1-3.5 percent from 4-7 percent amid a challenging demand environment.

FII holdings in Tata Consultancy Services (TCS), the country's largest software exporter, fell to 12.46 percent in the June quarter from 12.72 percent, the eleventh consecutive quarter of sell-offs by foreign investors.

Tech Mahindra Ltd also experienced a reduction in FII holding by over 100 basis points, bringing it down to 25.69 percent from 26.87 percent in the previous quarter. This is the tenth straight quarter of foreign investors trimming stake in Tech Mahindra.

Tech Mahindra’s June quarter net profit declined 38 percent to Rs 692 crore in the June quarter, which CEO CP Gurnani said was one of the toughest quarters in the last five years.

One basis point is one-hundredth of a percentage point.

Read: Royalty-like arrangement for ITC Hotels to use ITC brands: Sanjiv Puri on demerger

Other IT firms like Coforge Ltd, L&T Technology Services Ltd, LTIMindtree Ltd, Mphasis Ltd, Affle India, Birlasoft Ltd and Persistent Systems Ltd also witnessed selling by foreign investors during the June quarter.

For Persistent Systems Ltd, L&T Technology Services Ltd, and LTIMindtree it was second quarter in a row of FII selling, while Mphasis Ltd saw FII outflows for the third consecutive quarter.

Bucking the trend

Wipro Ltd and HCL Technology, however, bucked the trend as they reported a spurt in foreign funds flow. FII raised stake in HCL Tech for the third successive quarter and Wipro the second consecutive quarter.

Other midcap IT firms that also saw FII buying are Cyient Ltd, KPIT Technologies Ltd, Zensar Technologies Ltd, Sonata Software Ltd and Tata Elxsi Ltd.

Read: NSE Q1 profit up 9% at Rs 1,844 crore, contributes Rs 7,889 crore to the exchequer

Demand worries

The selling by foreign institutional investors (FII's) can be attributed to the weak earnings reported by many IT firms in both March and June quarters.

These companies also provided guidance for the upcoming quarters that were below market expectations. The divestment by FIIs shows a lack of confidence in the near-term outlook for these IT companies, according to analysts.

Indian IT firms are under pressure as analysts predict a global slowdown, which will likely hit IT spending in the US and Europe. Given that these regions contribute around 40 percent to Indian IT firms' revenues, there are concerns about the adverse effects on the companies' performance.

FIIs have withdrawn around $2.12 billion from the IT sector so far in 2023, Kotak Institutional data shows. They remained net sellers in 2022 and 2021, selling stocks worth around $9.27 billion and $3.23 billion, respectively.

Despite this pressure, mutual funds increased stakes in some midcap IT companies such as Coforge Ltd, CE Info Systems Ltd, Affle India Ltd, Zensar Technologies Ltd, Birlasoft Ltd, Persistent Systems Ltd, Tata Elxsi.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!