Keeping inflation and the limited social security options available to senior citizens in mind, it is vital for every individual to plan his/her retirement in advance.

While there are various investment options available to plan your retirement, one of the most traditional and popular ones is contributions to the Employees’ Provident Fund (EPF).

Also read: Deadline for choosing higher pension option extended to June 26: Your key questions answered

Employees’ Provident Fund (EPF)

Salaried individuals park their money in the EPF by contributing 12 percent of their salary (employee contribution), with their employers contributing an equal amount to the fund. The provident fund is a defined contribution plan, unlike other retirement planning schemes, which are linked to the market.

The EPFO is a statutory body administered by the government. Thereby, members are eligible to withdraw their Provident Fund corpus as a lumpsum amount (including the yearly interest earned on their contributions) at retirement.

Also read: Applying for higher EPFO pension? Key factors you must consider

National Pension Scheme (NPS)

In January 2004, the central government introduced the NPS, a voluntary pension system, with the objective of making retirement related savings for all citizens. Earlier, this option was available only to government employees. From 2009, NPS has been made available to every individual.

However, pension savings here are linked to market conditions. Hence, the returns are not fixed and will depend on the performance of the scheme. An individual who joins the NPS is able to routinely deposit to a pension account throughout his/her working career.

After retirement, he/she can take out a portion of the corpus and has to utilise the rest to purchase an annuity (thereafter, a fixed amount - pension - is paid to the individual at regular intervals for the rest of his/her life).

The NPS offers the following important features to help subscribers save for retirement:

The subscriber will be allotted a unique Permanent Retirement Account Number (PRAN). This unique account number will remain the same for the rest of the subscriber's life. This unique PRAN can be used from any location in India.

PRAN will provide access to two personal accounts:

Tier I Account: This is an account meant for retirement savings.

Tier II Account: This is simply a voluntary savings facility. The subscriber is free to withdraw savings from this account whenever he/she wishes. No tax benefit is available on this account.

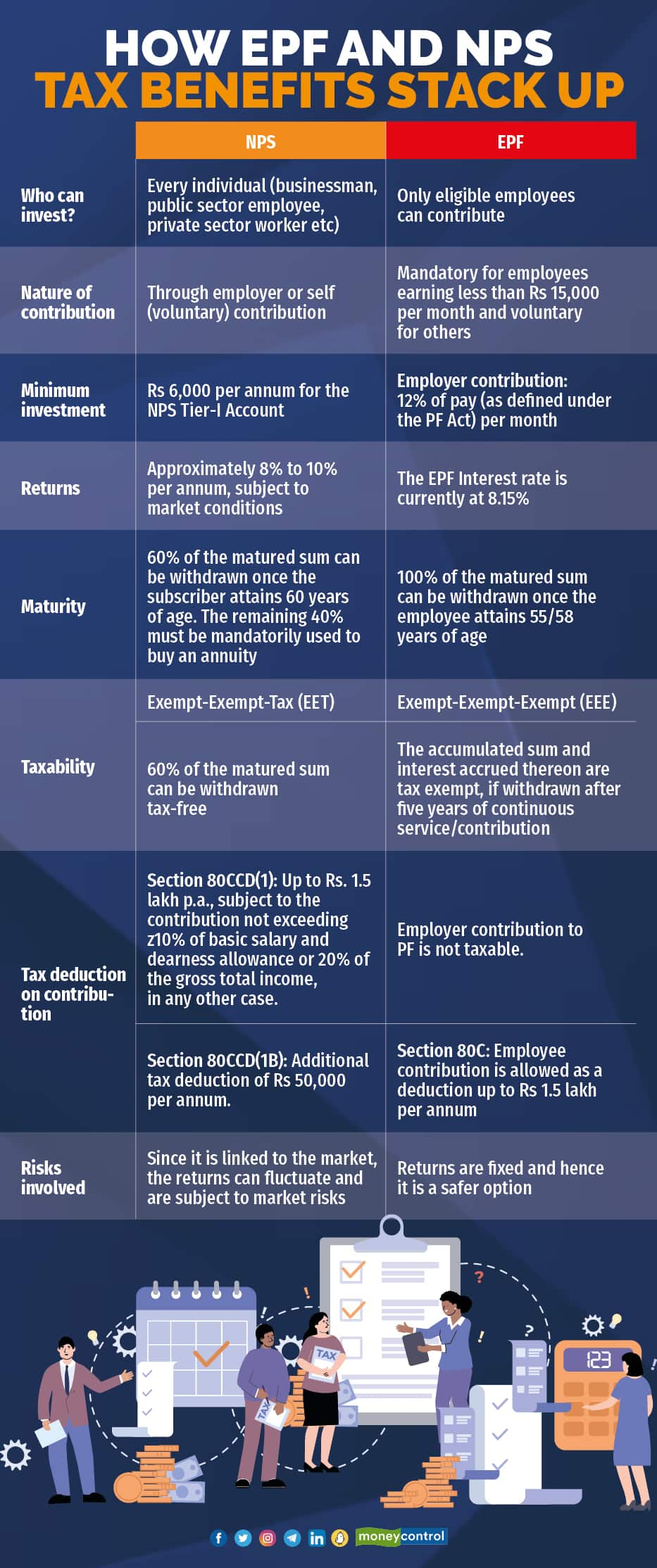

Here is quick summary of key differences between the two schemes:

(Do note that interest earned on EPF contributions over Rs 2.5 lakh a year are taxable). Investors should consider various factors while deciding between NPS and EPF, including their liquidity needs, expected returns and risk appetite.

Contrary to some beliefs, choosing both EPF and NPS is the best option, because they function as complementary forms of investment.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!