Less than five years after a shadow banking crisis spooked India’s financial sector and forced a retreat by lenders from all but the highest-rated credit, a growing list of global asset managers is moving to fill the gap.

Apollo Global Management, Cerberus Capital Management LP and Varde Partners are stepping up their operations in the world’s most populous nation, funding billionaires and mid-sized businesses for needs as diverse as acquisitions, bridge financing for initial public offerings, and share buy backs.

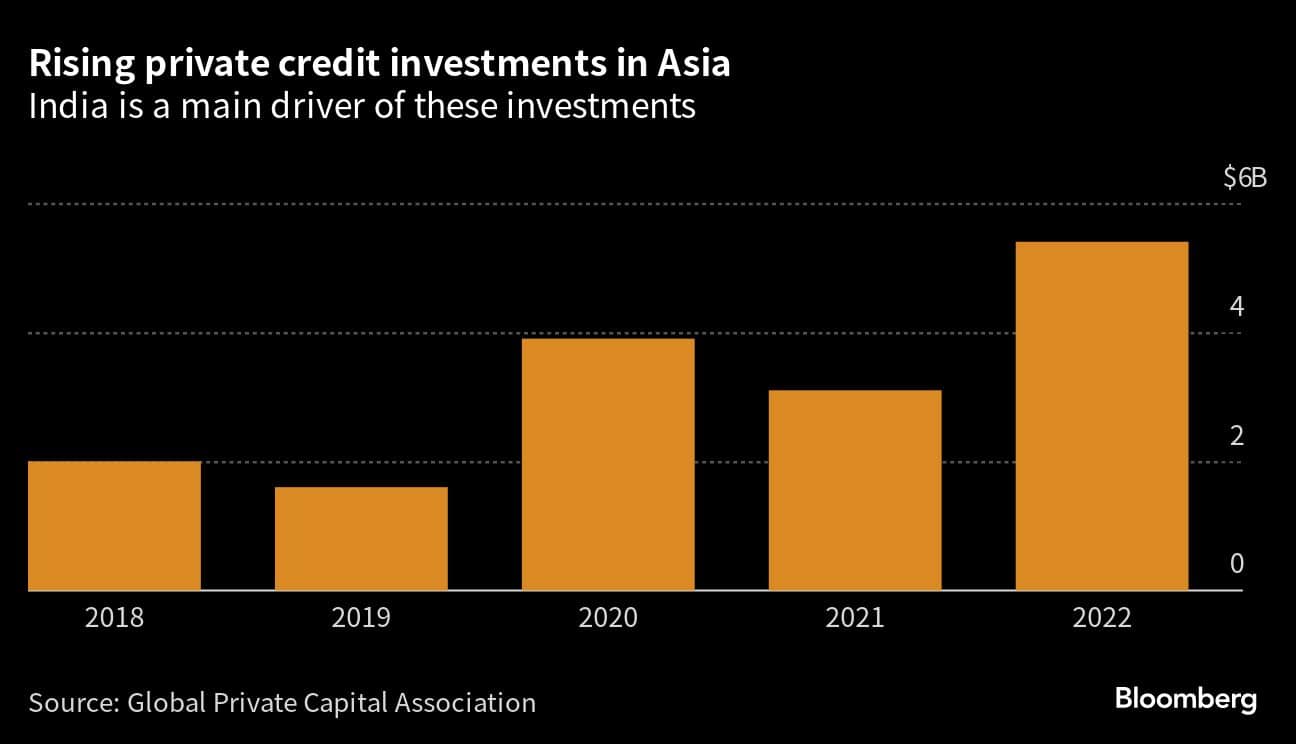

India-focused assets under management in private debt - the business of lending directly to companies - nearly doubled to $15.5 billion as of December 2022 from a year earlier, according to the most recent numbers from financial data provider Preqin. Over the last five years, the country notched up the highest investment volume in Asia, according to research from the Global Private Capital Association, a body representing investors.

“There are global managers sitting on the fence who have regular dialogues with us on the Indian private credit opportunity,” according to Bharat Gupta, partner at Ernst & Young India. He expects more to join the fray in the next couple of years.

The growth in private lending illustrates broader asset flows in India. Alternative investments reached a record 3.4 trillion rupees ($41.5 billion) in March, according to the Securities and Exchange Board of India. That’s come as money has flowed out of mutual funds in the wake of an earlier credit crisis.

Read More: Fresh Crisis Looms for India Shadow Banks After Fund Shuts

While still a fraction of the global $1.5 trillion assets under management for private credit, India has become a hotspot for alternative asset managers specialized in lending at higher interest rates. Apollo is hunting for a credit chief to spearhead its efforts in the country. Carlyle Group is holding exploratory talks to build out a private credit business in India, people familiar with the matter had said.

Varde Partners is expanding in India after deploying about $3 billion in private credit deals in the last five years, said Sandeep Chandak, senior managing director at the firm.

Meanwhile, local firms True North Managers LLP, Kotak Investment Advisors Ltd. and Edelweiss Alternative Asset Advisors have set up private credit funds. Axis Bank Ltd. has begun pitching a $244 million credit fund to largely lend capital for acquisition financing, according to Salil Pitale, joint managing director and co-chief executive of Axis Capital.

To be sure, competition is also putting pressure on lenders.

“India is somewhat crowded,” SC Lowy co-founder Soo Cheon Lee said in a recent interview. “The country’s economy is doing fantastic, and because of that, borrowers are also becoming more demanding.”

Private debt can be thought of as private equity’s cousin. It raises capital from investors, usually large institutions such as pension funds and insurers. While a private equity firm buys all or some of a company, private credit firms typically gain no ownership and just lend money to a company directly—putting themselves at the front of the line for repayment in a default.

The size of private credit deals has steadily increased and this year, a few transactions crossed $1 billion, according to Indranil Ghosh, managing director at Cerberus’s India office. Cerberus is focused on special situations, real estate and non-performing loans within private credit.

“We expect this trend to continue and eventually for private credit to be much larger than private equity in India, as is the case globally,” Ghosh said.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!