The National Pension System (NPS) has become one of the preferred retirement options in India. Through NPS, you accumulate a retirement corpus in your working life, part of which can be withdrawn as a lumpsum while exiting, while the other part must go into an annuity scheme that provides a monthly income.

As per data provided by the Handbook of NPS 2023, there were 1,09,344 subscribers who opted for annuity plans since the NPS was launched. Of them, 70 percent chose the Annuity for Life with Return of Purchase Price (ROP) plan. Under this plan, annuity income is paid to the subscriber and after the demise of the subscriber, the principal amount is paid to a nominee.

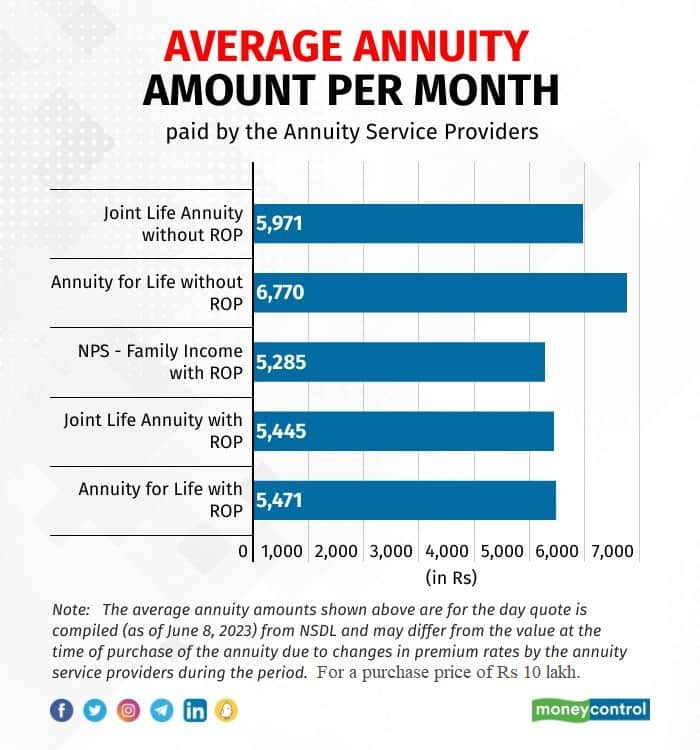

While as much as 15 types of annuity plans are available in the market, most of the NPS subscribers opted for the ‘Annuity for life with ROP’ plan. It is one of the most popular annuity plans among pensioners. If a private sector NPS subscriber aged 60 invests Rs 10 lakh in the plan today, then the person will get a monthly pension of about Rs 5,471 for a lifetime and on the death of the subscriber, the annuity payment ceases and Rs 10 lakh goes to the nominee.

The second-most popular plan was the Joint Life Annuity with Return of Purchase Price plan, where the spouse gets the benefit.

Also read: NPS assets at Rs 9 lakh cr, subscriber base at 6.3 cr as of March 2023: PFRDA

Compulsory annuity

Currently, NPS gives subscribers the option to withdraw 60 percent of the corpus accumulated at the age of 60. Subscribers can defer the lumpsum withdrawal till the age of 75. But the remaining 40 percent has to be invested in an annuity scheme for regular pension. In case of a premature exit, subscribers will have to invest 80 percent of the corpus in an annuity plan.

Although the amount invested and capital gains from the investment in NPS are tax-free on withdrawal, the amount paid as pension will be added to income and taxed as per the applicable slab of the NPS subscriber.

Also see: NPS Equity funds shine, but struggles to beat broader indices

Subscribers can choose from the various schemes offered by 15 life insurance companies empanelled with the NPS – also called Annuity Service Providers (ASPs). These annuity schemes ensure that NPS subscribers get a regular guaranteed income stream after their retirement.

Most popular annuity plans

ASPs offer various annuity options, but the most popular ones include:

1) Annuity for Life with Return of Purchase Price: The subscriber gets annuity for life and on the death of the subscriber, the payment of annuity ceases and 100 percent of the purchase price is given to the nominee(s).

2) Joint Life Annuity with Return of Purchase Price: The subscriber will get annuity for life and on the death of the subscriber, annuity will be payable to the spouse for life. On the death of the spouse, the payment of annuity ceases and 100 percent of the purchase price goes to the nominee(s).

3) NPS - Family Income Option with Return of Purchase Price: The subscriber will get annuity for life and on the death of the subscriber, annuity is payable to the spouse for life (if any). On the death of the spouse, annuity is paid to the dependent mother and then to the dependent father of the subscriber. On the death of the last annuitant, payment of annuity ceases and 100 percent of the purchase price is returned to the surviving children of the subscriber or to the legal heirs, as applicable.

4) Annuity for Life without Return of Purchase Price: The subscriber will get annuity for life and on the death of the subscriber, the payment of annuity ceases and no further amount is payable.

5) Joint Life Annuity without Return of Purchase Price: The subscriber will get annuity for life and on the death of the subscriber, annuity will be payable to the spouse for life. On the death of the spouse, the payment of annuity ceases and no further amount is payable.

The rates offered by ASPs differ for each annuity plan. The chart below shows the average annuity amount paid by 15 ASPS to a private sector subscriber at the age of 60 for a Rs 10 lakh purchase price. The amounts are calculated as per the current rates provided by the ASPs.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!